ElectricBuilder

Member

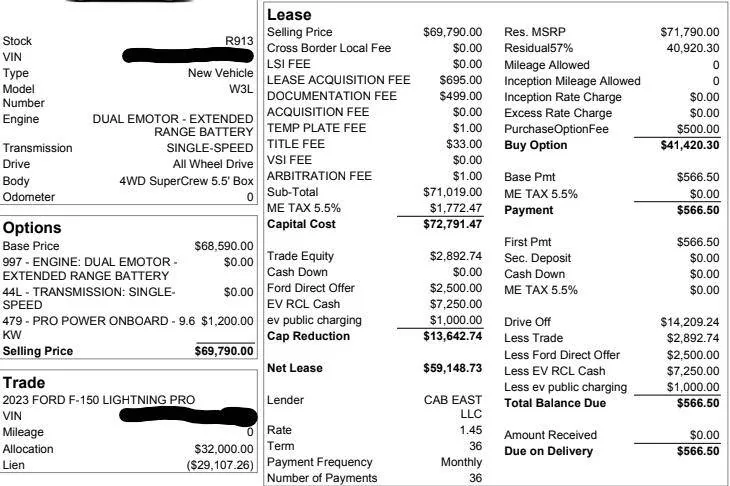

Great deal. Curious how you guys are working these days....dealers don't seem so ready to deal right now.I signed last week of November

24 flash with max tow, power bored, spray on bed

36/15k $550 a month with $2,5k DAS, no tesla or ram rebate

Sponsored