GrokTime

Well-known member

- First Name

- Sean

- Joined

- Apr 19, 2022

- Threads

- 6

- Messages

- 156

- Reaction score

- 91

- Location

- Ithaca, NY

- Vehicles

- 2022 F150 Lightning, Rivian R1S 1st Gen

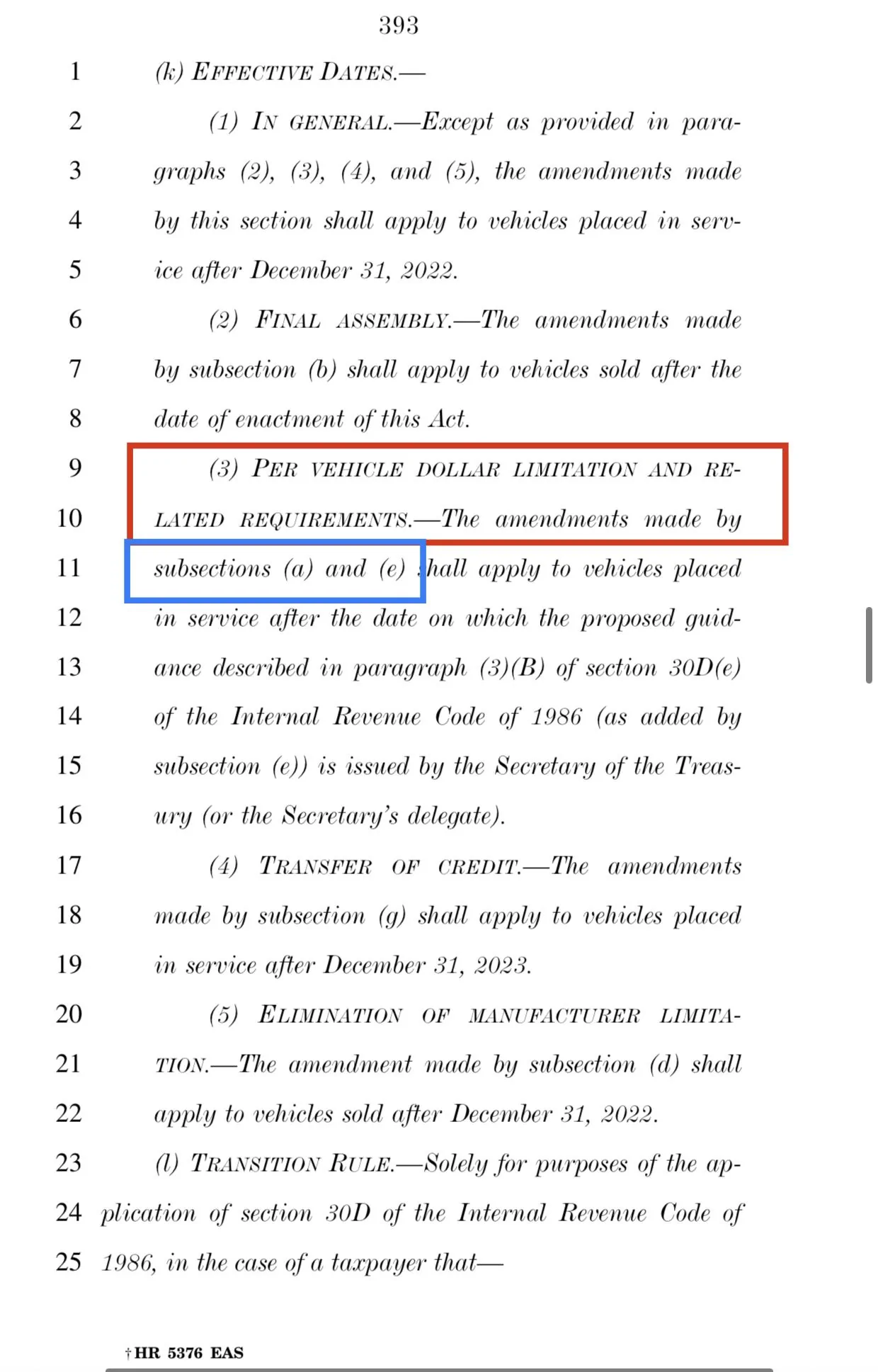

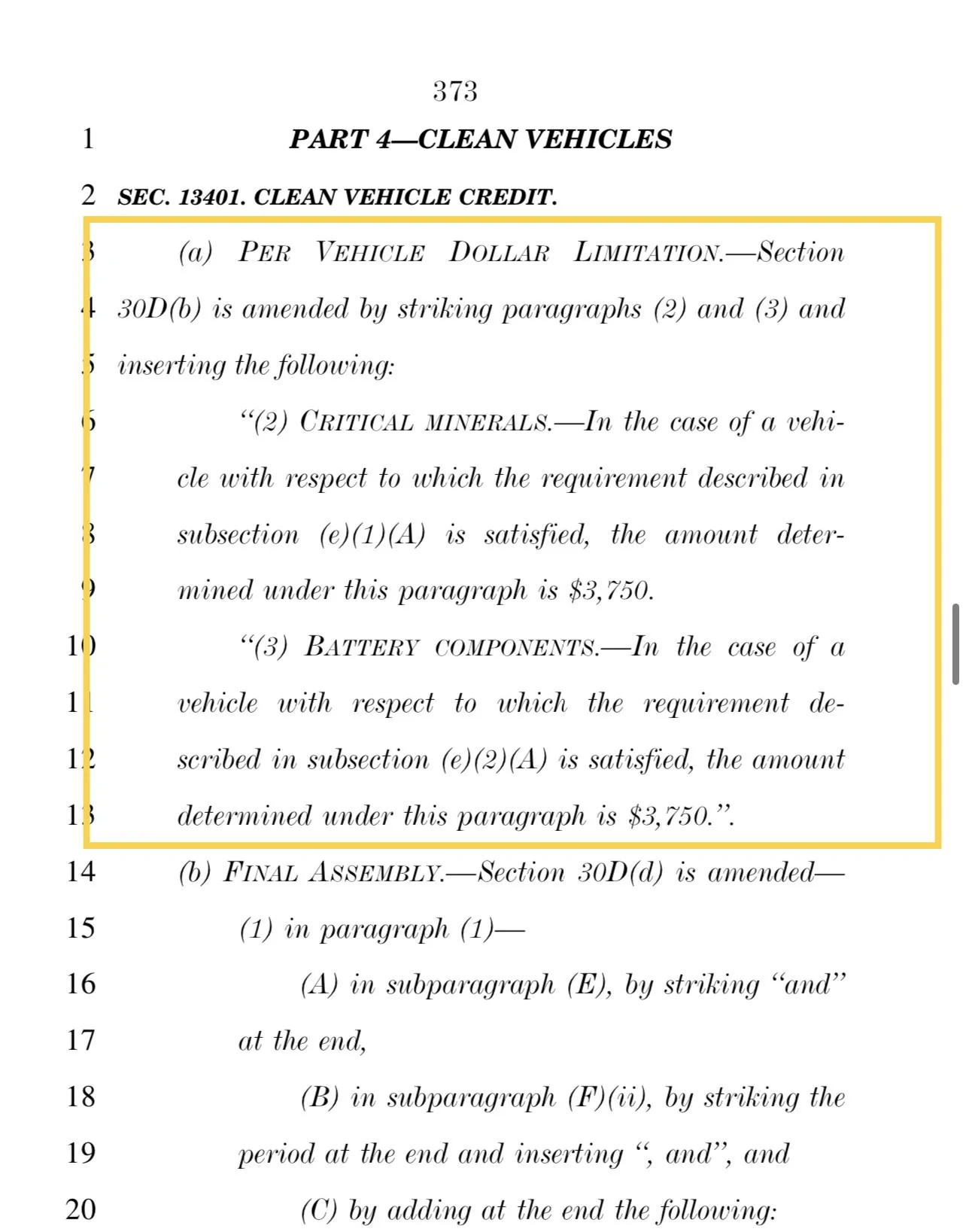

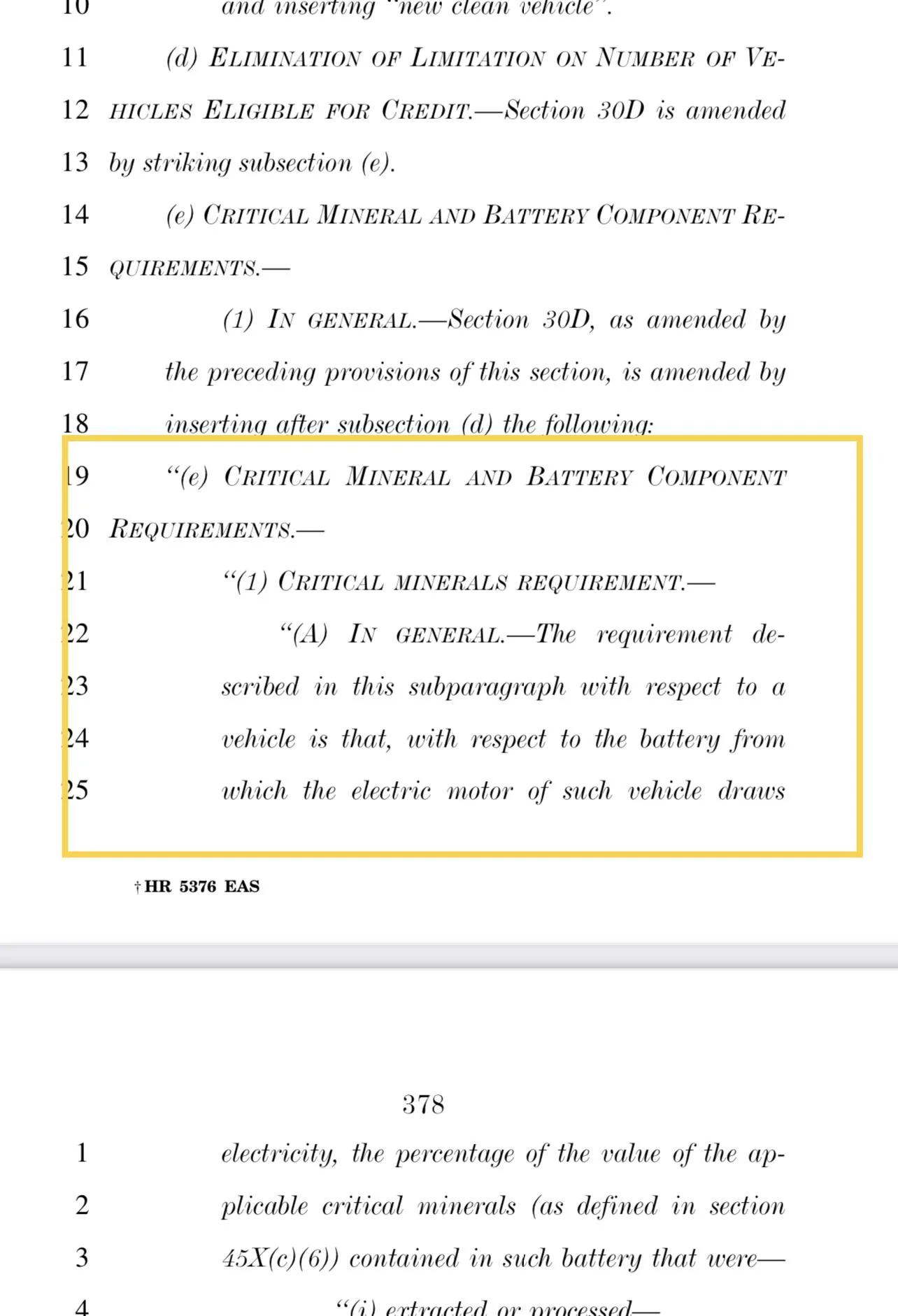

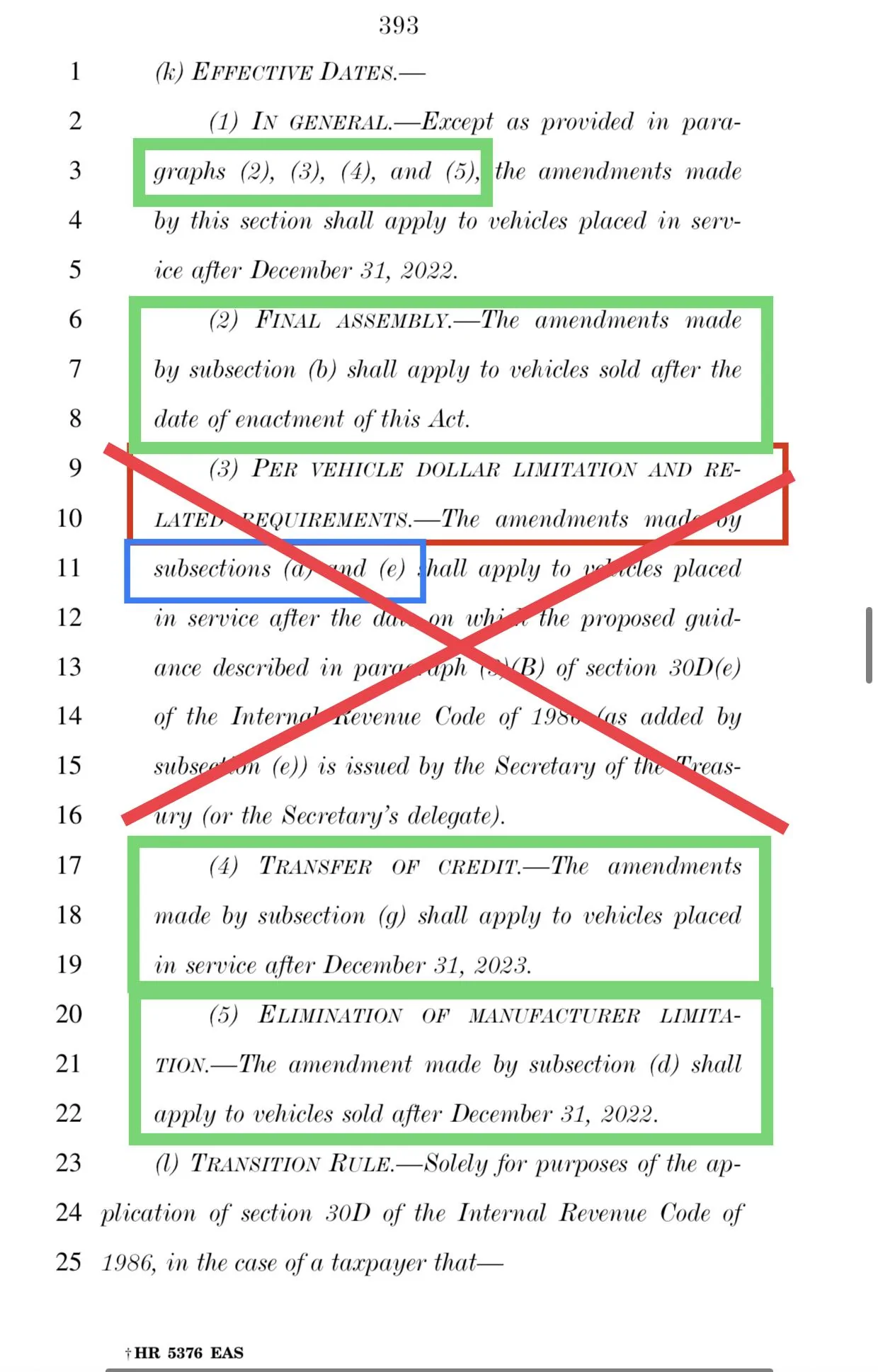

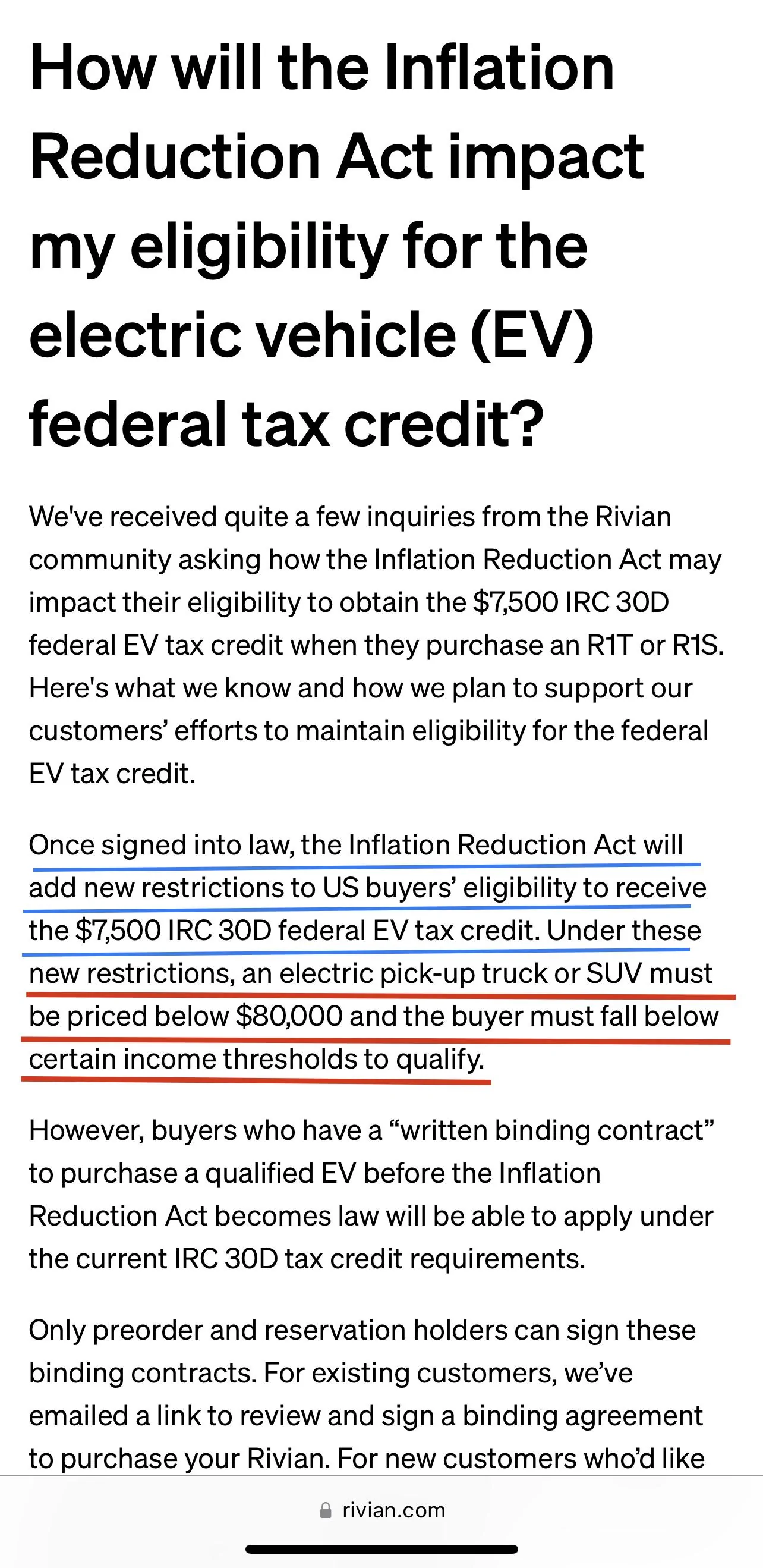

I agree. Basically my reading is that in general a non-refundable deposit is not enough for the IRS to consider the contract to be binding. However, despite that, if the deposit is at least 5% then they will treat it as binding.

Sponsored