Sponsored

Here's How Rivian is Handling the IRA 2022 EV Tax Credit Uncertainty

Simpso57

Well-known member

Got the same email. For those of us that locked in our price before the March increases, but won't be taking delivery this year, seems like a no brainer.

vandy1981

Well-known member

- Thread starter

- #3

It will be the steal of the century if they can sell me the quad motor Max Pack R1T for $85K and I'm able to claim the full tax credit. Especially in light of the recent Lightning price increases.Got the same email. For those of us that locked in our price before the March increases, but won't be taking delivery this year, seems like a no brainer.

gorwell

Well-known member

- First Name

- Andrew

- Joined

- Jul 19, 2021

- Threads

- 18

- Messages

- 819

- Reaction score

- 1,120

- Location

- Sacramento

- Vehicles

- Ioniq 5 / XLT Standard

This sent me down rabbit hole.

All 2022 deliveries for The F150L qualify for the full credit, right?

When Biden signs the law, the only thing that changes immediately would be it need to be assembly in the US, which is fine.

Needing at least 40% battery from US doesn't apply until Next Year deliveries (w/o signed purchase order), correct?

All 2022 deliveries for The F150L qualify for the full credit, right?

When Biden signs the law, the only thing that changes immediately would be it need to be assembly in the US, which is fine.

Needing at least 40% battery from US doesn't apply until Next Year deliveries (w/o signed purchase order), correct?

AB852

Active member

- Joined

- Sep 29, 2021

- Threads

- 3

- Messages

- 38

- Reaction score

- 46

- Location

- California

- Vehicles

- F150 Lightning

Once he signs, the new income limits and max MSRP go into affect. Even for 22 vehicles.This sent me down rabbit hole.

All 2022 deliveries for The F150L qualify for the full credit, right?

When Biden signs the law, the only thing that changes immediately would be it need to be assembly in the US, which is fine.

Needing at least 40% battery from US doesn't apply until Next Year deliveries (w/o signed purchase order), correct?

Sponsored

ExCivilian

Well-known member

Yeah...I never did place a Rivian order even though I was really excited about that truck. At the time, $80K wasn't something I wanted to spend on an EV even if it is a truck. After taking the Ford survey I was also confident they'd be offering the battery pack for an a la carte expense of roughly $10K.

Now I'm in a Lariat ER and the Rivians are even more expensive than they used to be.

1. Congress passes a bill

2. President signs bill into law

3. customer is not impacted until IRS publishes its interpretation of the new rules.

Now I'm in a Lariat ER and the Rivians are even more expensive than they used to be.

I'd say read it again to verify what I'm about to post here but I believe it explicitly states that income limits, etc. go into effect only after the IRS issues its guidance on the new law.Once he signs, the new income limits and max MSRP go into affect. Even for 22 vehicles.

1. Congress passes a bill

2. President signs bill into law

3. customer is not impacted until IRS publishes its interpretation of the new rules.

Amps

Well-known member

- Joined

- Feb 21, 2022

- Threads

- 5

- Messages

- 1,336

- Reaction score

- 1,521

- Location

- Mid-Atlantic

- Vehicles

- Bolt

I don't know who is correct, but that's not how Rivian seems to read it wrt to grandfathering the §30D tax credit and staying outside the $80k MSRP cap and income limits.I believe it explicitly states that income limits, etc. go into effect only after the IRS issues its guidance on the new law.

ExCivilian

Well-known member

Where does Rivian state that?I don't know who is correct, but that's not how Rivian seems to read it wrt to grandfathering the §30D tax credit and staying outside the $80k MSRP cap and income limits.

I was responding to how AB852 was interpreting Rivian's interpretation--not what they wrote in their press release. Their press release is accurate.

Tyler Durden

Well-known member

Almost certainly yes. Even MY2023 deliveries prior to 12/31/2022 (if any). 2022 deliveries can use the "old" rules.All 2022 deliveries for The F150L qualify for the full credit, right?

The confusion stems from the "transition rule," but with one extremely unlikely exception(*), the transition rule does not apply to F150L's

(*) if there is some MSRP guidance forthcoming prior to 12/31/2022. But on closer reading of that section of the IRA, I think that only applies to the battery metals requirement, not the MSRP requirement section 13401 (f) / (11)(B)(iii) on page 393

ridgebackpilot

Well-known member

- First Name

- Michael

- Joined

- Aug 7, 2022

- Threads

- 9

- Messages

- 100

- Reaction score

- 109

- Location

- Monterey Peninsula, California

- Vehicles

- 2022 Lightning Lariat ER, 2022 Mustang Mach-E GTPE

- Occupation

- Conservationist

Actually the tax credit in the bill applies to vehicles manufactured in North America, which includes the USA, Canada, and Mexico. So both the Lightning and Mustang Mach-E should be covered.When Biden signs the law, the only thing that changes immediately would be it need to be assembly in the US, which is fine.

Sponsored

Amps

Well-known member

- Joined

- Feb 21, 2022

- Threads

- 5

- Messages

- 1,336

- Reaction score

- 1,521

- Location

- Mid-Atlantic

- Vehicles

- Bolt

Your bullet point #3 seems to conflict with Rivian's guidance to obtain a binding contract to maintain grandfathering.

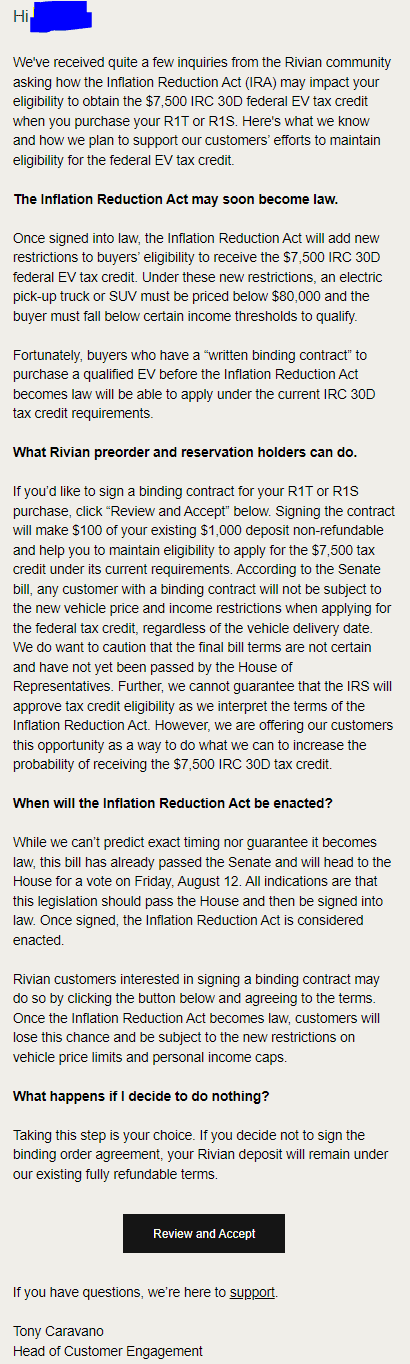

Once signed into law, the Inflation Reduction Act will add new restrictions to buyers' eligibility to receive the $7,500 IRC 30D federal EV tax credit. Under these new restrictions, an electric pick-up truck or SUV must be priced below $80,000 and the buyer must fall below certain income thresholds to qualify.

While we can't predict exact timing nor guarantee it becomes law, this bill has already passed the Senate and will head to the House for a vote on Friday, August 12. All indications are that this legislation should pass the House and then be signed into law. Once signed, the Inflation Reduction Act is considered enacted.

Further, we cannot guarantee that the IRS will approve tax credit eligibility as we interpret the terms of the Inflation Reduction Act. However, we are offering our customers this opportunity as a way to do what we can to increase the probability of receiving the $7,500 IRC 30D tax credit.

Tyler Durden

Well-known member

The Rivian blurb in the OP does not mention the 12/31/2022 effective date (deliberately perhaps). I know nothing about Rivian, but I'm guessing there are still many orders that won't be delivered until after 12/31/2022, so they just sent this to all their order holders.

sotek2345

Well-known member

- First Name

- Tom

- Joined

- Jun 7, 2021

- Threads

- 34

- Messages

- 3,906

- Reaction score

- 4,716

- Location

- Upstate NY

- Vehicles

- 2022 Lightning Lariat ER, 2021 Mach-e GT

- Occupation

- Engineering Manager

That is not true, read the text. The MSRP limits go into effect once the new guidance is issues, not when the bill is signed. That is targeted for the end of December.Once he signs, the new income limits and max MSRP go into affect. Even for 22 vehicles.

Tyler Durden

Well-known member

Lots of discussion about the nuances & confusion in several threads here. e.g. this one:

https://www.f150lightningforum.com/...-new-bill-and-havent-gotten-your-truck.11617/

I'm still convinced that for all F150L's and probably Rivians delivered on or before 12/31/2022, we're using the "old" rules.

https://www.f150lightningforum.com/...-new-bill-and-havent-gotten-your-truck.11617/

I'm still convinced that for all F150L's and probably Rivians delivered on or before 12/31/2022, we're using the "old" rules.

FlasherZ

Well-known member

- Joined

- Mar 10, 2022

- Threads

- 9

- Messages

- 915

- Reaction score

- 1,027

- Location

- St. Louis Metro

- Vehicles

- F-150 Lightning, Tesla Model X, F250 SD diesel 6.0

Keep in mind that Ford's use of this to keep people under the "old rules" also includes the phase-out for the $7,500 rebate once Ford hits 200,000 EV's (which will be this quarter or next). That means that you'll only get 50% credit for deliveries beginning 1/1/2023 or 4/1/2023 (depending upon which quarter they hit the 200,000), and then 6 months after that it reduces to 25%.

Sponsored

Similar threads

- Replies

- 8

- Views

- 3,634

- Replies

- 23

- Views

- 8,545

- Replies

- 8

- Views

- 6,510