Geo

Well-known member

I have been thinking of ordering a EV, with a large capacity battery. Then find somewhere I could charge it for free while at work or shopping. Then I could go home and use it to live off the grid.

Sponsored

I’ll take my $7,500 back anytime the guilt gets to be too much....Had an EV, took advantage of the FREE government discount......for the 3 years I owned the vehicle, nothing ruined the EV experience more than the guilt of that $7500 discount.

You are picking up what I am laying down......I’ll take my $7,500 back anytime the guilt gets to be too much....

I agree that people should pay a reasonable share of road costs (assuming gas taxes even go to that, etc.). The issue is that road damage is not linear with weight. It's exponential, and as such, it's really unlikely that the tax is going to be done in an way that matches up with actual damage done by each vehicle.In a way I don't have an issue with this, even being an EV owner. EVs are heavy (even a Leaf can be close to 2 tons) and heavy vehicles contribute more to road wear than a lighter one, all things being equal. Taxing to fund road maintenance and expansion as a function of miles driven per year and the weight of a vehicle would be a somewhat objective way of having those that contribute the most to the wear of the roads pay the most, though like any tax change, it will ruffle feathers somewhere and have ripple effects across things indirectly tied to transportation.

Now, I suppose that perhaps everyone should share the BUILD costs more evenly, but the repair costs basically go exclusively to big trucks.“The damage due to cars, for practical purposes, when we are designing pavements, is basically zero. It’s not actually zero, but it’s so much smaller -- orders of magnitude smaller -- that we don’t even bother with them,” said Karim Chatti, a civil engineer from Michigan State University in East Lansing.

A ballpark calculation of relative damage is...

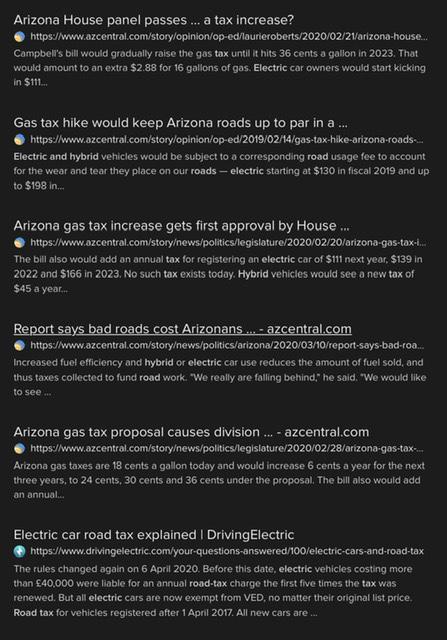

I already get taxed on mileage with Vehicle Registration fees which are much higher for EVs than ICE at least in CaliforniaI think everyone's bigger worry should be when EVs and every car for that matter starts getting taxed on mileage. Fuel taxes are already insufficient for needed road repair. When EVs reach a certain saturation, it's only a matter of time!

In Arizona, Vehicle Lecence tax for EV is changed to a rate of $4 per $100 of assessed valuation, which is determined by the following.I already get taxed on mileage with Vehicle Registration fees which are much higher for EVs than ICE at least in California

Using your cell phone analogy, the $12500 or even the $7500 government incentive is the same as when Obama gave out free cell phones.This thread has taken a bit of an interesting turn to a debate about the efficacy and equality of the potential $12,500 tax incentive as opposed to its possibility.

When it comes to the allocation of repair costs, I would consider utility vs actual impact, meaning that there is more untility of an 18 wheeler delivering low cost consumer goods vs me driving to work. No one would be happy paying $2 more for bread because the Walmart has to pay a 10x tax for using trucks on the road. The solution is probably tolls, but no one wants to be the person who implements them on previously un-tolled roads. It’s a political nightmare.

Regardless of my interest in this car, I think the tax credit is smart. EVs are still an emerging technology and the more that are on the road, the more advancements there will be in technology and infrastructure. I think about it like a cell phone. They were once a brick in a suitcase, but now are more advanced than computers most of us were using even 10 years ago. Sign me up for $12,500 on the hood. Heck, I’ll even be happy with just the $7,500 sticking around.

Oh yeah, for sure. It'll never happen the way it SHOULD happen.The main problem with this argument is that it includes math and a politician will on listen to emotion. The politician's eyes will roll up into the back of their head until they hear someone yell, "...their fair share!"

The Lifeline program (or more recently called "Obamaphone") began in 1985 under Reagan. But hey, if you don't want the credit, you are certainly free to reject it, just like a free phone.Using your cell phone analogy, the $12500 or even the $7500 government incentive is the same as when Obama gave out free cell phones.

Just not proud of taking welfare from taxpayers, especially when I can afford it.The Lifeline program (or more recently called "Obamaphone") began in 1985 under Reagan. But hey, if you don't want the credit, you are certainly free to reject it, just like a free phone.