Dino

Well-known member

- First Name

- Dean

- Joined

- Mar 2, 2024

- Threads

- 2

- Messages

- 66

- Reaction score

- 37

- Location

- Nashville area

- Vehicles

- 23 XLT Lightning, 25 Cadillac Optiq all electric

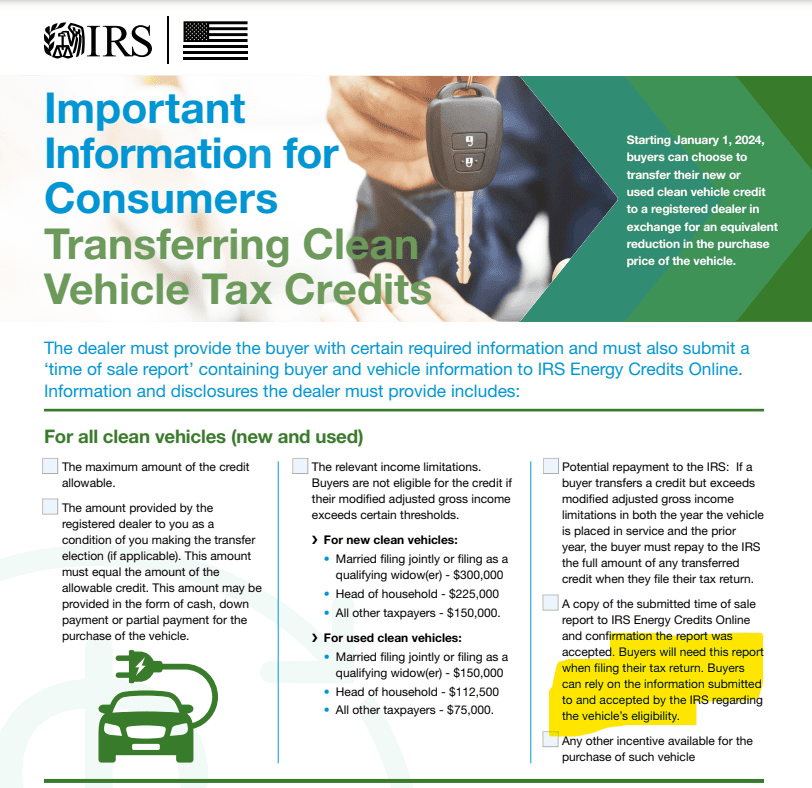

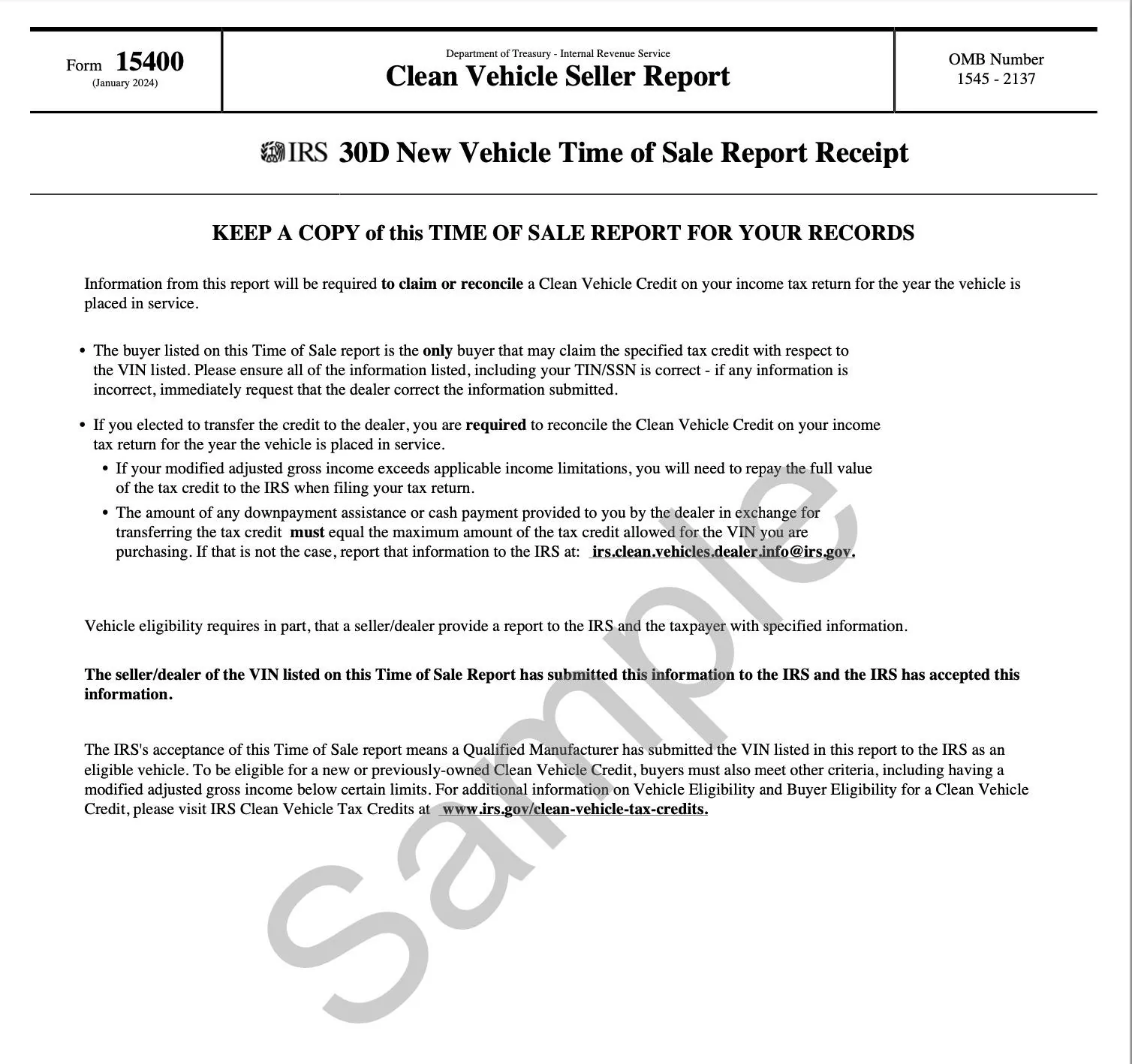

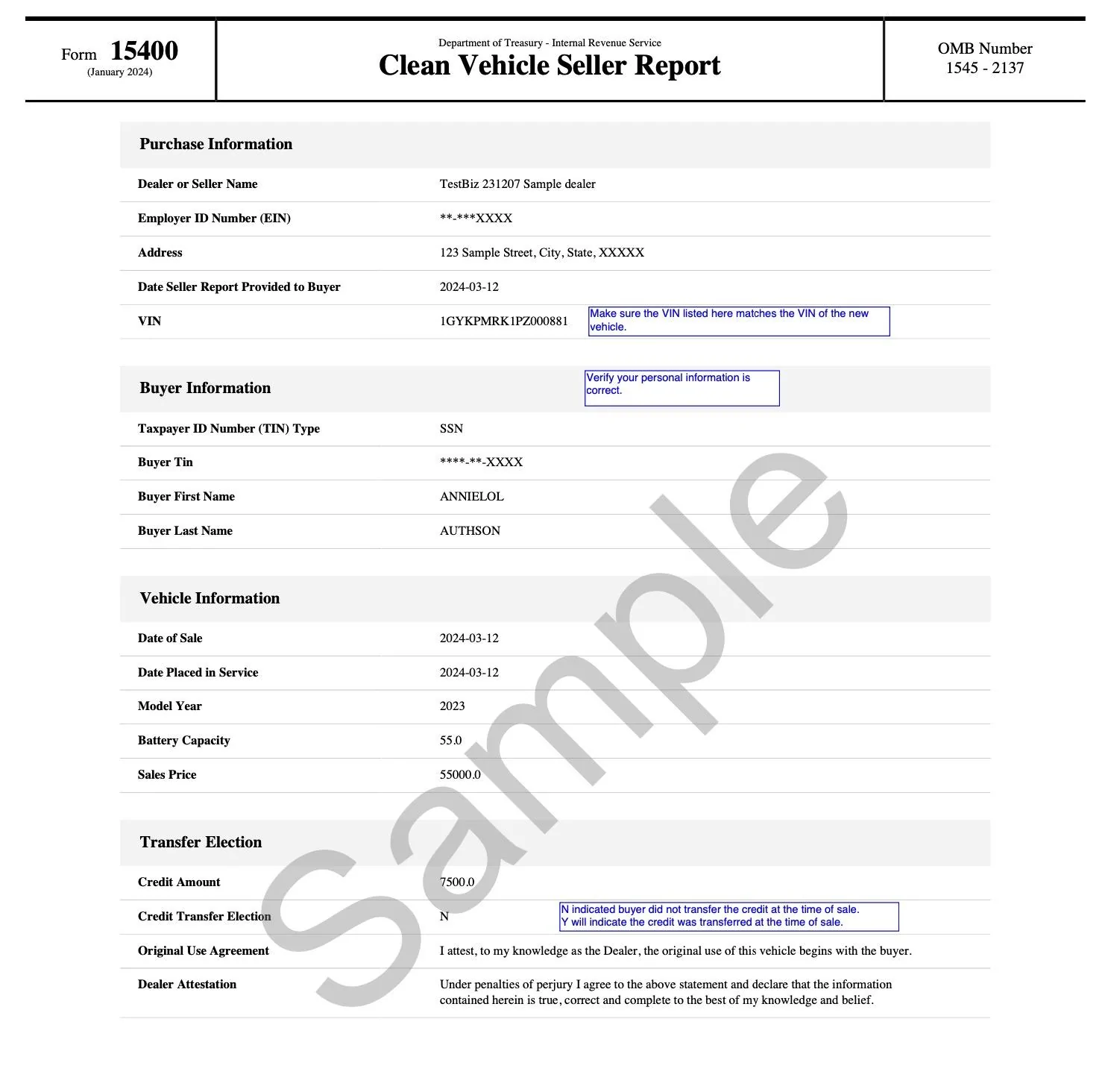

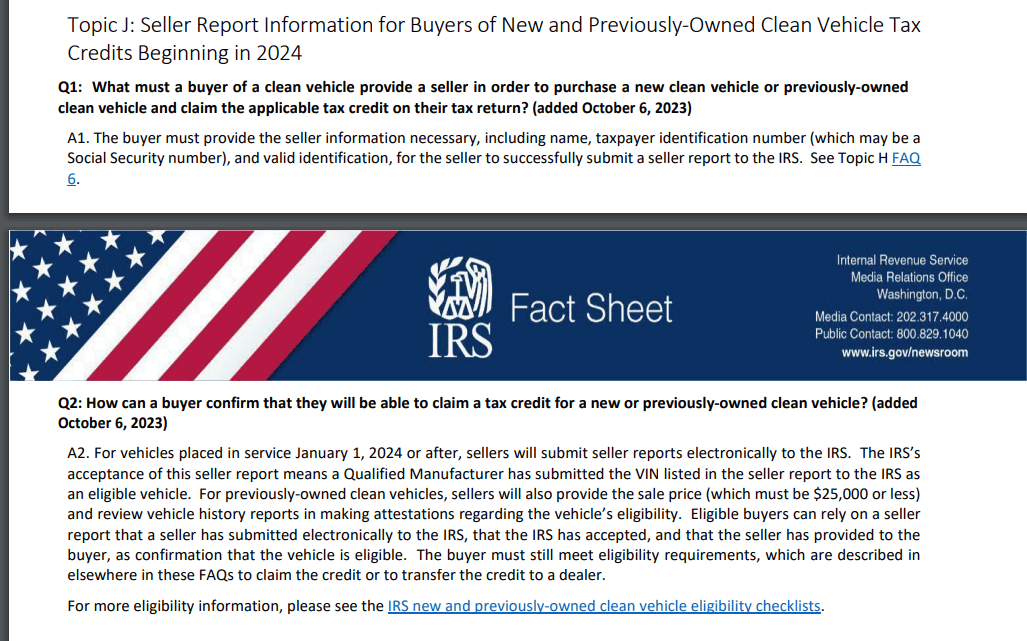

I purchased my new 2023 Lightning XLT on Jan. 4, 2024. I talked to several dealers in the Nashville area about the new tax rebate rules but none of them knew anything about it. Finally one dealer said they could give me the $7,500 rebate credit so I bought my 60k truck from them. I have asked them several times for the IRS form to no avail. They did give me a $7,500 so called rebate but I am sure it was just a price reduction to get the truck off their lot. I am able to buy Ford vehicles utilizing Ford Z Plan (below dealer cost) and used it to purchase this truck.

I just wonder how many 2024 purchase date Lightning/Mach E buyers actually have received the correct IRS paperwork?

Myself and my Lightning fully qualify for the tax rebate.

I just wonder how many 2024 purchase date Lightning/Mach E buyers actually have received the correct IRS paperwork?

Myself and my Lightning fully qualify for the tax rebate.

Sponsored