CM_in_TX

New member

- Joined

- Sep 3, 2021

- Threads

- 1

- Messages

- 3

- Reaction score

- 1

- Location

- South Texas

- Vehicles

- 96 F150 Lariat

- Thread starter

- #1

Lightning totally fits my use case, and I love the idea of Frunk. However, it only works in my budget if I get the government tax credit of $7500.

I searched up “EV tax MSRP limit” and the current limit seems to be $74,000 MSRP for trucks. (The $80,000 limit was in a bill that didn’t pass, or is delayed to long in the future.)

Based on $74,000 assumption, it may be that I can get a Lariat with many options, but not the Extended Range Battery, which is highly desirable. (because Lariat MSRP + 7000 puts one over 74,000)

Or, I could go down to an XLT, add Extended Range Battery, and any other options I could fit, such as Pro Power Onboard, Co-Pilot Assist, Tow Tech pkg, 8-way power driver seat, etc. However, some options I want, aren’t available on XLT trim, such as Power Deployable Running Boards, 15-inch screen, BlueCruise, etc.

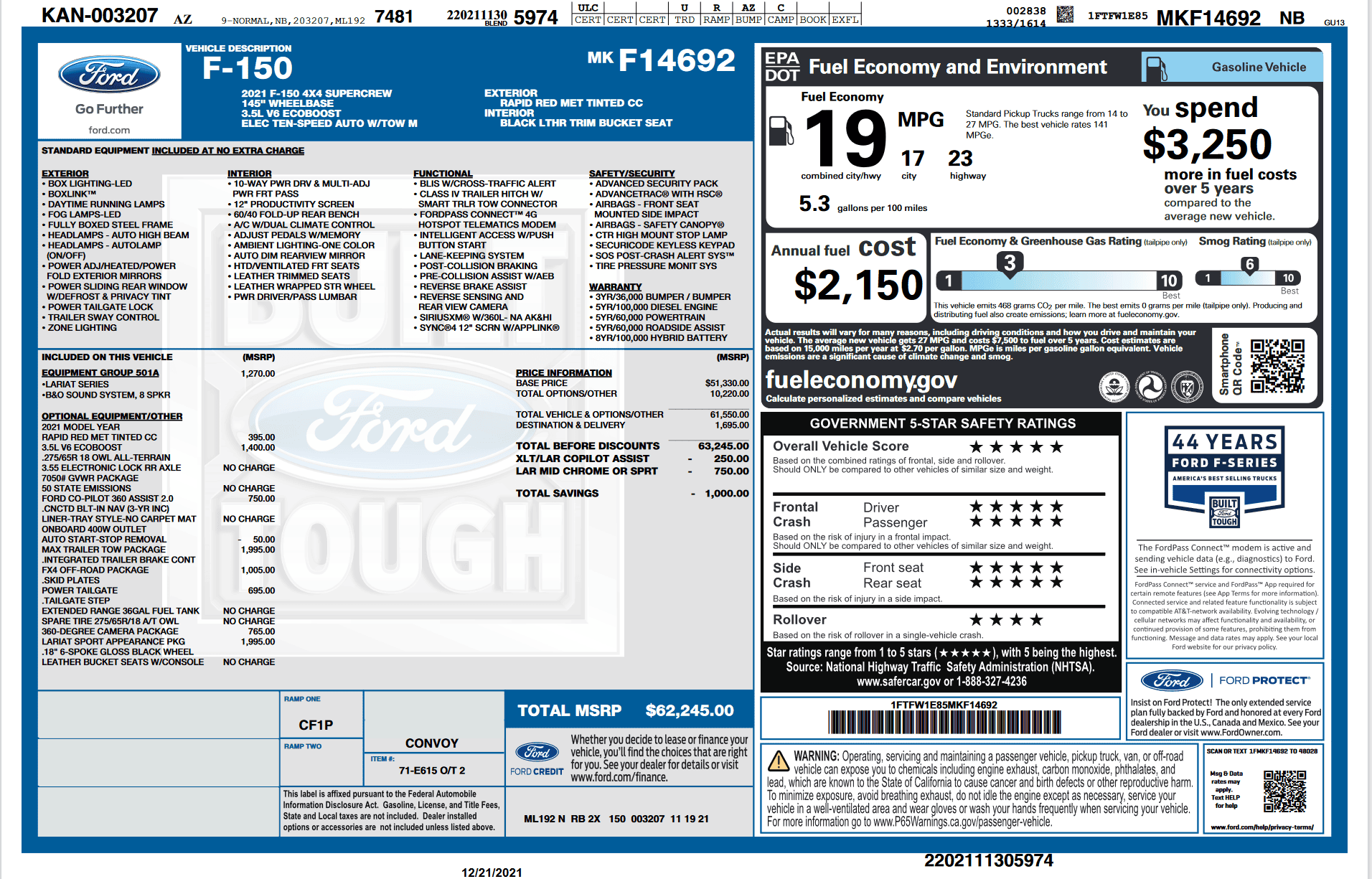

I say all that for a question on what defines MSRP: if I build and price an ICE F-150, in the Summary I end up with:

-Base MSRP

-Total of Options

-Destination Charges

-Acquisition Fee

-Then, “Total MSRP”

-Available Incentives

-Estimated Net Price

So assuming the tax credit is truly based on Total MSRP and not Net Price, could a dealer add “ADM” instead of Available incentives, and MSRP is still below $74,000 and qualify for $7500 credit?

If so, it would be nice of Ford to either reduce Lariat base MSRP, or decrease the cost of the Extended range battery. Such that Base MSRP + Battery = $73,999. But then the dealer adds in ADM to make up the MSRP reduction… Is this avoiding intended taxes, or evading intended taxes?

Thank you for any thoughts on whether Lariat without battery, or XLT with battery would be the truck to order, assuming the final MSRP is close to $74000 as possible.

I searched up “EV tax MSRP limit” and the current limit seems to be $74,000 MSRP for trucks. (The $80,000 limit was in a bill that didn’t pass, or is delayed to long in the future.)

Based on $74,000 assumption, it may be that I can get a Lariat with many options, but not the Extended Range Battery, which is highly desirable. (because Lariat MSRP + 7000 puts one over 74,000)

Or, I could go down to an XLT, add Extended Range Battery, and any other options I could fit, such as Pro Power Onboard, Co-Pilot Assist, Tow Tech pkg, 8-way power driver seat, etc. However, some options I want, aren’t available on XLT trim, such as Power Deployable Running Boards, 15-inch screen, BlueCruise, etc.

I say all that for a question on what defines MSRP: if I build and price an ICE F-150, in the Summary I end up with:

-Base MSRP

-Total of Options

-Destination Charges

-Acquisition Fee

-Then, “Total MSRP”

-Available Incentives

-Estimated Net Price

So assuming the tax credit is truly based on Total MSRP and not Net Price, could a dealer add “ADM” instead of Available incentives, and MSRP is still below $74,000 and qualify for $7500 credit?

If so, it would be nice of Ford to either reduce Lariat base MSRP, or decrease the cost of the Extended range battery. Such that Base MSRP + Battery = $73,999. But then the dealer adds in ADM to make up the MSRP reduction… Is this avoiding intended taxes, or evading intended taxes?

Thank you for any thoughts on whether Lariat without battery, or XLT with battery would be the truck to order, assuming the final MSRP is close to $74000 as possible.

Sponsored