EvEddy

Active member

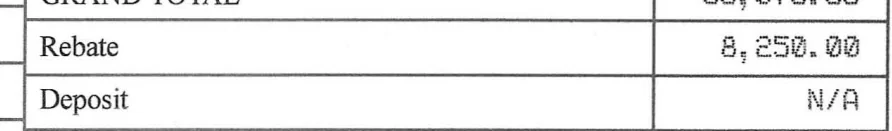

The removal of one rebate and the addition of 60mths @0% or 72mths @1.9% is just another way of packaging the lost rebate.. the only way you'd lose out is if you were able to refinance or sold. Im still seeing a lot of '23's on the lot so I dont think the discounts are over yet.

Sponsored