ExCivilian

Well-known member

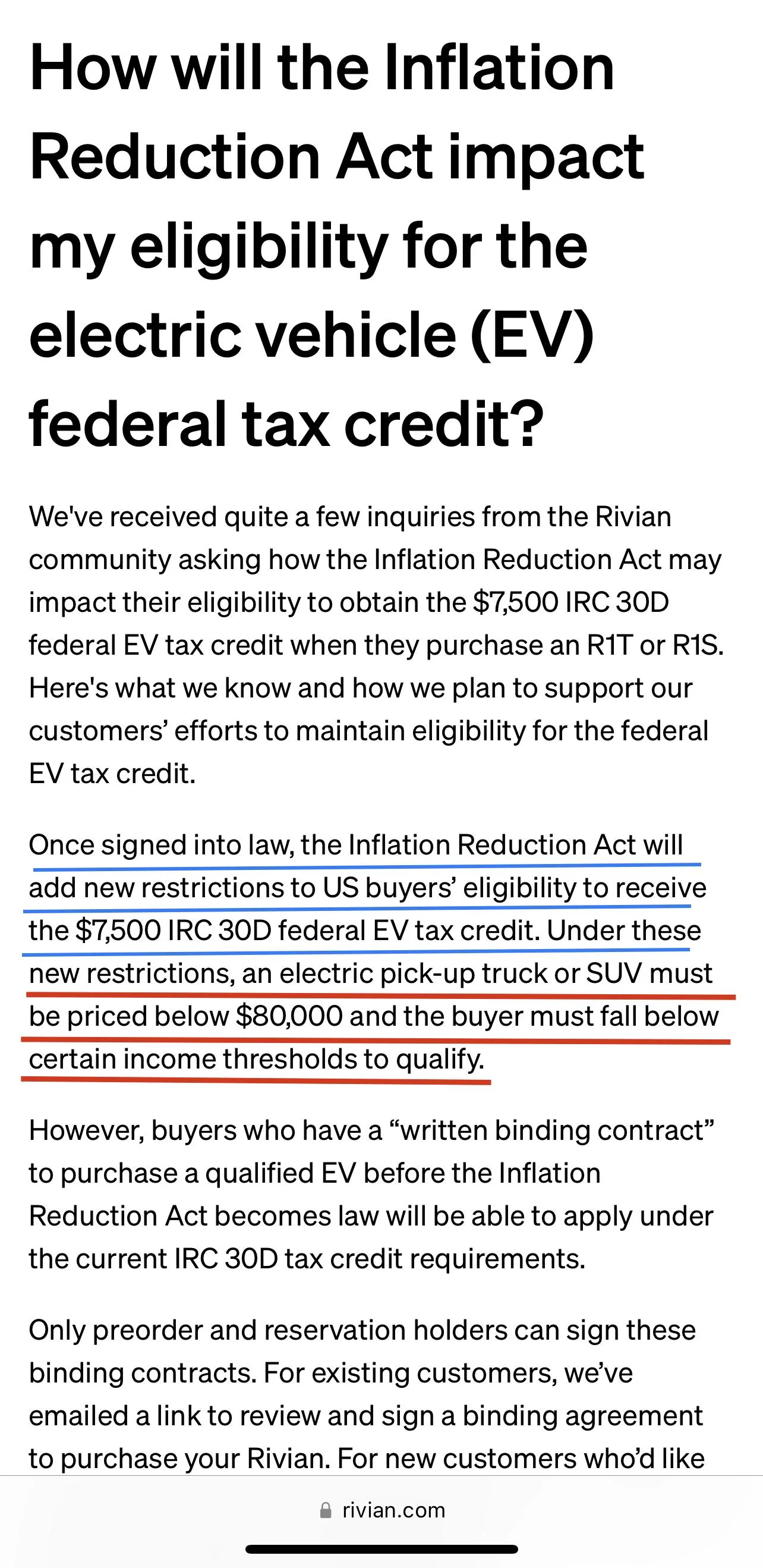

What good reason did you have to intentionally not mention Rivian when you claimed that only non-domestic manufacturers were making public announcements?I didn’t mention Rivian (for good reason)

Rivian is a domestic manufacturer and they're making these statements.

You incorrectly labeled Fisker as a non-domestic manufacturer so you can drop the attitude regarding that. In fact, just drop the attitude entirely since multiple members have mentioned it's dragging the thread down...

Sponsored