Zaptor

Well-known member

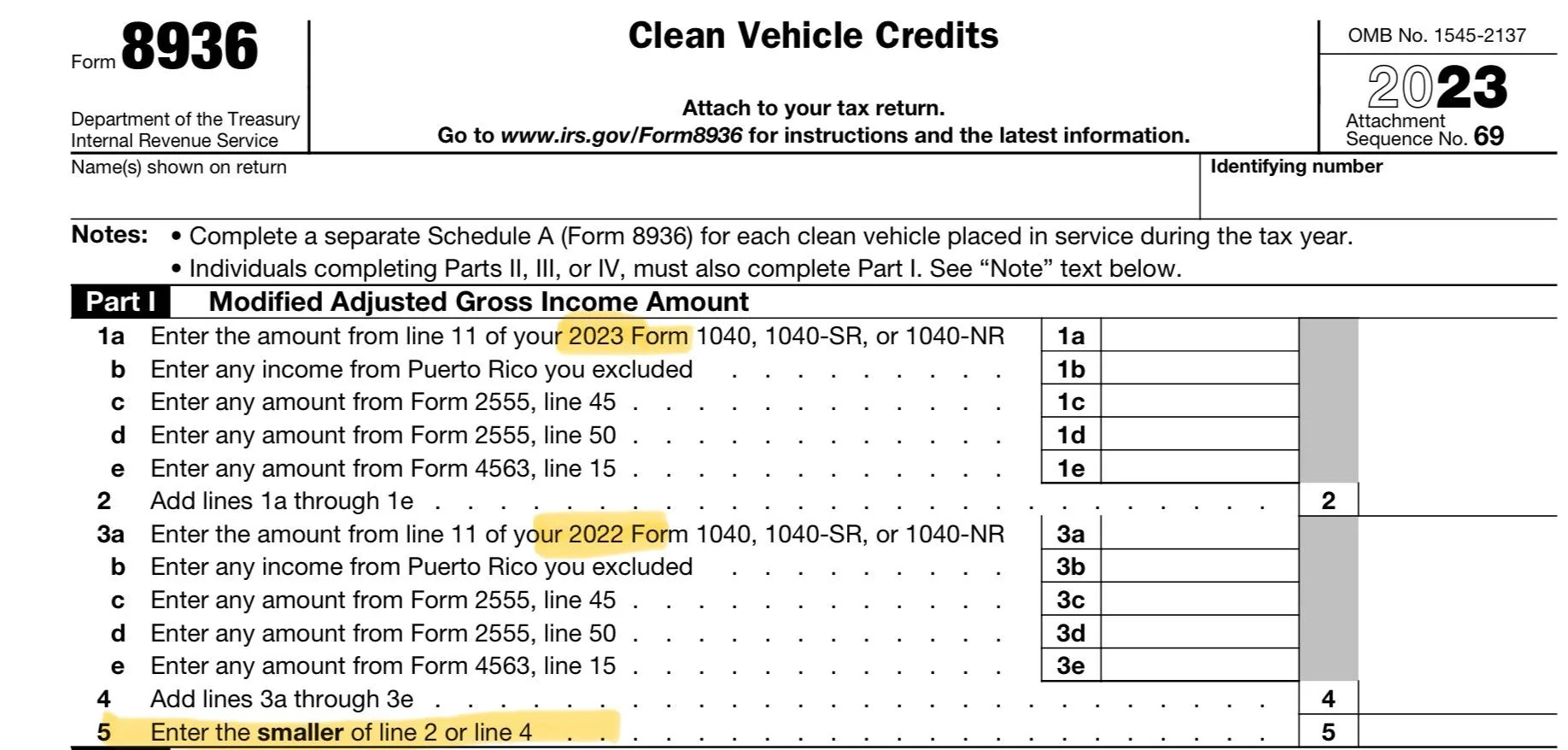

Yeah the tax liability isn't the issue, def more than $15k but as I am not a CPA I will just cross my fingers and hope that the one I employ can work it out for me. Thanks for giving me hope and yeah, don't care about the couple hundred for the electrical work but $15k *was* expected given the press on the credits...Of course every situation is different but I was able to claim the $15K for the two EV's since I had tax liability greater that 15K (1040 line 16). But I wasn't able to claim the ~$200 credit for charger infrastructure (installing my FCSP) due to the AMT clause mentioned above.

Sponsored