1375mlm

Member

- Thread starter

- #1

Currently In the last few steps of finalizing a Lightning, for which there’s 0% APR being offered.

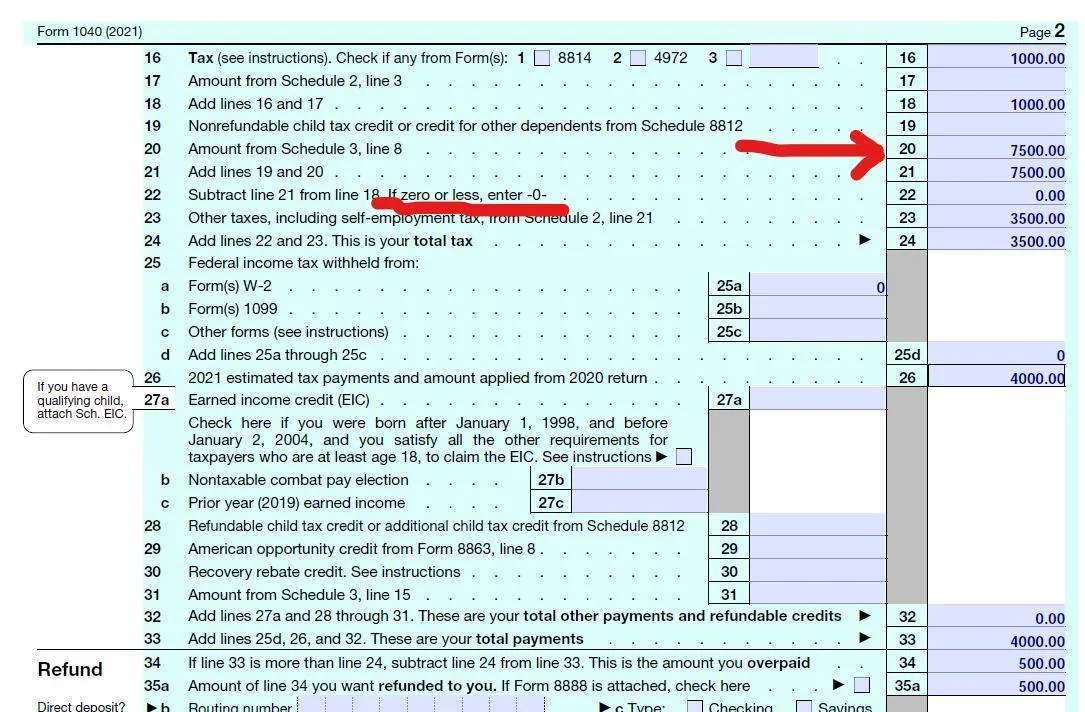

As a result, we decided to not push the 7500 tax credit into the loan/lower the price of the car, but instead delay it until tax time to get that cash upfront. Obviously this increases the loan amount, but as the APR is low, we’d rather have the cash now.

Looking at the IRS website, they state the following:

“Seller must give you a time-of-sale report and a copy of the confirmation the IRS provides when it accepts the time-of-sale report submitted through IRS ECO”

But no information as to what these look like, what qualifies as these docs, or any other details.

Has anyone done this before? Any tips?

Thanks!

As a result, we decided to not push the 7500 tax credit into the loan/lower the price of the car, but instead delay it until tax time to get that cash upfront. Obviously this increases the loan amount, but as the APR is low, we’d rather have the cash now.

Looking at the IRS website, they state the following:

“Seller must give you a time-of-sale report and a copy of the confirmation the IRS provides when it accepts the time-of-sale report submitted through IRS ECO”

But no information as to what these look like, what qualifies as these docs, or any other details.

Has anyone done this before? Any tips?

Thanks!

Sponsored