cvalue13

Well-known member

- Joined

- Jul 24, 2022

- Threads

- 23

- Messages

- 789

- Reaction score

- 764

- Location

- Austin, Texas

- Vehicles

- ‘22 Lightning ER Lariat

- Occupation

- Fun-Employed

- Thread starter

- #1

It will be months before the IRS issues guidance and interpretation on the IRA, including the much-discussed MSRP caps. Until then, nobody (least of all me) knows exactly how the IRS will define these MSRP caps.

Still, I’ve been curious to better anticipate how these MSRP caps may be interpreted, and through some digging have collected a couple of interesting tidbits, which at the end I apply to Ford’s MY2023 MSRP details.

The below TL; DR -> it may be possible for an Extended Range Lightning to slip under the IRA’s $80K MARP cap, if it is possible to have a dealer delete >$975 of standard equipment from from the XLT ER (with a head start already provided by the already “required” deletion of the onboard scales).

But the web to get there takes a sleepless night of dreaming up the IRS guidance to come, as follows:

(1) Prior IRS guidance on “MSRP” points to the laws behind the “Monroney Sticker” requirements

One prior IRS vehicle tax-credit precedent guidance I found concerned the long-ago expired (2010) “qualified alternative fuel motor vehicle” (QAFMV) credit. For the QAFMV, the law based the credit on an MSRP calculation, and so the IRS issued guidance that amongst other things defined/clarified the relevant sense of MSRP (my emphasis in underline, quoted only in relevant part):

“.03 Manufacturer’s Suggested Retail Price. If the manufacturer of a QAFMV or a mixed-fuel vehicle is required under 15 U.S.C. § 1232 to provide a manufacturer’s suggested retail price for the vehicle, then the manufacturer’s suggested retail price for the vehicle is the price provided in accordance with 15 U.S.C. § 1232 for that vehicle….”

The code section referenced above, 15 U.S.C. § 1232, is the underlying substance of the Monroney Sticker.

(2) Unhelpfully, 15 U.S.C. § 1232 does not itself make reference to “manufacturer’s suggested retail price”

Below I post the relevant portions of the code, my emphasis again underlined:

“Every manufacturer of new automobiles distributed in commerce shall, prior to the delivery of any new automobile to any dealer, or at or prior to the introduction date of new models delivered to a dealer prior to such introduction date, securely affix to the windshield, or side window of such automobile a label on which such manufactures shall endorse clearly, distinctly and legibly true and correct entries disclosing the following information concerning such automobile —

(a) the make, model, and serial or identification number or numbers;

(b) the final assembly plant;

(c) the name, and the location of the place of business, of the dealer to whom it is to be delivered;

(d) the name of the city or town at which it is to be delivered to such dealer;

(e) the method of transportation used in making delivery of such auromobile, if driven or towed from final assembly point to place of delivery;

(f) the following information:

(g) if one or more safety ratings for such auromobile …. [omitting remainder]…”

Unhelpfully, nowhere does the statute itself reference the exact term “manufacture’s suggested retail price.” The IRS guidance instead says “the manufacturer’s suggested retail price for the vehicle is the price provided in accordance with 15 U.S.C. § 1232 for that vehicle.” For this language, statute item Item (1) appears to be the nearest match, then, as “retail price of such automobile suggested by the manufacturer.”

Noting that item (2) is a requirement to list not the “retail price” of the automobile, but instead the retail “delivered” price, “for each accessory or item of optional equipment, physically attached to such automobile,” I deduce (from my armchair) that item (2) is not included within the IRS’s notion of “manufacturer’s suggested retail price for the vehicle” but instead the “MSRP” for the optional equipment. (And more certainly it’s not the case that item (3), delivery charges, are a “retail price” at all, much less inherent to the price of the vehicle.)

Instead (from my armchair), the IRS’s notion of “MSRP” for the vehicle I take to relate only to item (1) in the statute. (If anyone has on-point rulings from the IRS relarinf to the QAFMV credit definition of MSRP, that might settle it!)

On this view,” “MSRP” appears to mean the price of the base trim level before options or delivery.

(3) The view that “MSRP” mean the price of the base trim level before options and delivery is probably supported by examples of Monroney Stickers

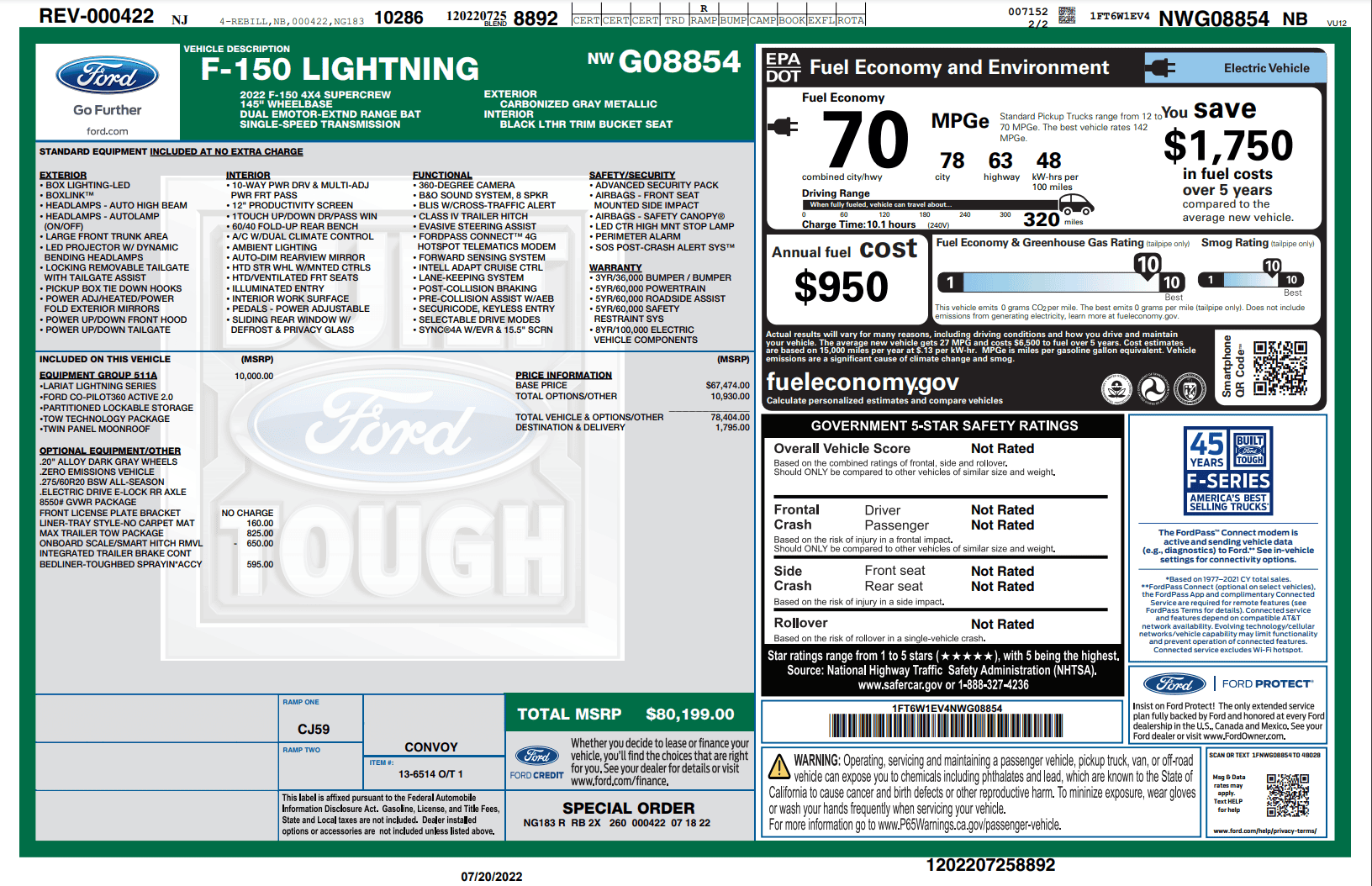

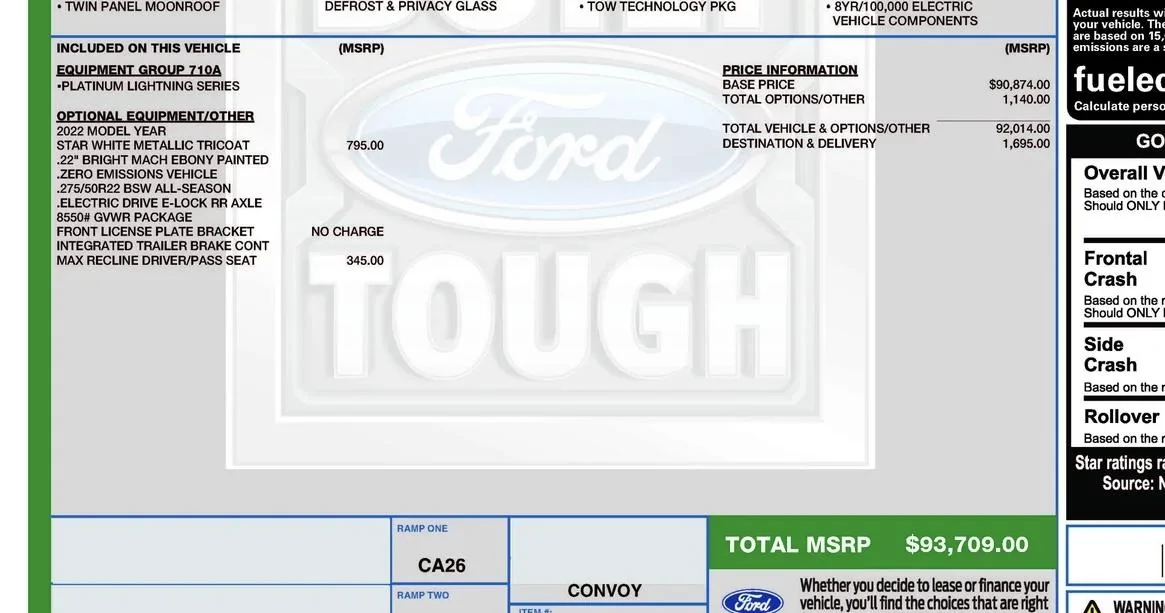

Taking this view of “MSRP,” it has the benefit of seeming to square with the Monroney Sticker themselves:

Note that there is listed an “MSRP” for the vehicle, separately from the “MSRP” for the options, and together - along with D&D - described as “total” MSRP.

Looking at the sticker alone, one might worry if the new EV law’s reference to “MSRP” could be to the “total” number on the sticker; but looking first to the IRS’s prior guidance and the operative code language regarding the MSRP for “the vehicle,” as distinct from MSRP for options/D&D, the sticker instead seems to support the read that the IRS is looking to - in effect - the base trim level MSRP, before options.

(4) What does this mean for MY23 F150L?

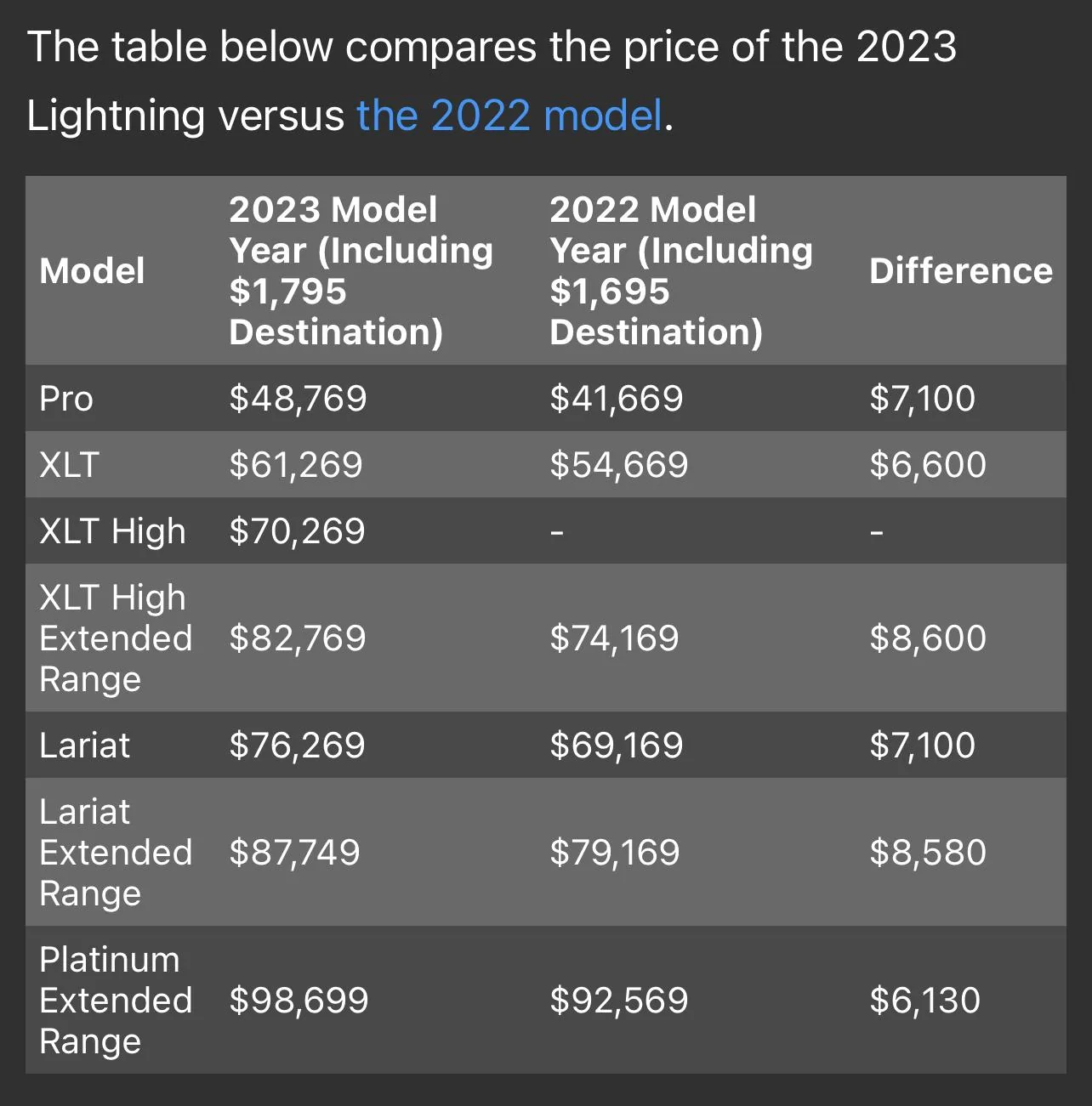

From over here at Motor1.com I pulled this helpful little chart, which I assume to be accurate regarding what little is currently known for Ford’s released MY23 pricing:

However, since we (I?) believe D&D is excluded from the IRS-relevant notion of MSRP, I’ve further backed the above numbers down to exclude D&D and then stoplight color-coded for what does or doesn't hit the notional IRA cap for pickup MSRPs:

I’ve placed the XLT ER in yellow, because when I saw the price within spitting distance of the MSRP cap I wondered something fanciful: if chip shortages continue to result in “required deletions” from a trim level, are any applicable to the XLT ER, and if so could the resulting price reduction >$975?

For example, the on board scales are a part of the XLT ER, and are I believe a known “required” deletion for 2023 orders (so far). To what price reduction?

And, I believe that these deleted “standard” items result in Ford issuing a window sticker with a reduced “base” MSRP.

(5) In fact, could a dealer build an XLT ER with a sub-$80K sticker MSRP?

Setting aside chip shortage deletions, and maybe more to the point: could a customer ask their dealer to order an XLT ER that proactively deletes certain “standard” equipment, and receive a price reduction for those equipment deletions?

If so, is there non-critical XLT ER equipment that could result in a >$975 price reduction? (Even better if it is equipment that could later be dealer-installed?)

If a person could up-front confirm with their dealer that the window-sticker would show a sub-$80K base MSRP, it might be possible to build an ER Lightning that comes in under the $80K IRA MSRP cap.

Of course, awaiting the IRA guidance from the IRS should prove out whether the above-described MSRP calculation is correct. And, anyone over the income cap is busted, anyway. Not to mention separately still needing a final understanding of the battery minerals and assembly requirements and where Ford comes out there.

Oh well. Perhaps the next inflection point in this fanciful thought will be seeing a window sticker for someone with an order that deleted the onboard scales, to see how that credit is reflected on the window sticker

Still, I’ve been curious to better anticipate how these MSRP caps may be interpreted, and through some digging have collected a couple of interesting tidbits, which at the end I apply to Ford’s MY2023 MSRP details.

The below TL; DR -> it may be possible for an Extended Range Lightning to slip under the IRA’s $80K MARP cap, if it is possible to have a dealer delete >$975 of standard equipment from from the XLT ER (with a head start already provided by the already “required” deletion of the onboard scales).

But the web to get there takes a sleepless night of dreaming up the IRS guidance to come, as follows:

(1) Prior IRS guidance on “MSRP” points to the laws behind the “Monroney Sticker” requirements

One prior IRS vehicle tax-credit precedent guidance I found concerned the long-ago expired (2010) “qualified alternative fuel motor vehicle” (QAFMV) credit. For the QAFMV, the law based the credit on an MSRP calculation, and so the IRS issued guidance that amongst other things defined/clarified the relevant sense of MSRP (my emphasis in underline, quoted only in relevant part):

“.03 Manufacturer’s Suggested Retail Price. If the manufacturer of a QAFMV or a mixed-fuel vehicle is required under 15 U.S.C. § 1232 to provide a manufacturer’s suggested retail price for the vehicle, then the manufacturer’s suggested retail price for the vehicle is the price provided in accordance with 15 U.S.C. § 1232 for that vehicle….”

The code section referenced above, 15 U.S.C. § 1232, is the underlying substance of the Monroney Sticker.

(2) Unhelpfully, 15 U.S.C. § 1232 does not itself make reference to “manufacturer’s suggested retail price”

Below I post the relevant portions of the code, my emphasis again underlined:

“Every manufacturer of new automobiles distributed in commerce shall, prior to the delivery of any new automobile to any dealer, or at or prior to the introduction date of new models delivered to a dealer prior to such introduction date, securely affix to the windshield, or side window of such automobile a label on which such manufactures shall endorse clearly, distinctly and legibly true and correct entries disclosing the following information concerning such automobile —

(a) the make, model, and serial or identification number or numbers;

(b) the final assembly plant;

(c) the name, and the location of the place of business, of the dealer to whom it is to be delivered;

(d) the name of the city or town at which it is to be delivered to such dealer;

(e) the method of transportation used in making delivery of such auromobile, if driven or towed from final assembly point to place of delivery;

(f) the following information:

(1) the retail price of such automobile suggested by the manufacturer;

(2) the retail delivered price suggested by the manufacturer for each accessory or item of optional equipment, physically attached to such automobile at the time of its delivery to such dealer, which is not included within the price of such automobile as stated pursuant to paragraph (1);

(3) the amount charged, if any, to such dealer for the transportation of such auromobile to the location at which it is delivered to such dealer; and

(4) the total of the amounts specified pursuant to paragraphs (1), (2), and (3);

(g) if one or more safety ratings for such auromobile …. [omitting remainder]…”

Unhelpfully, nowhere does the statute itself reference the exact term “manufacture’s suggested retail price.” The IRS guidance instead says “the manufacturer’s suggested retail price for the vehicle is the price provided in accordance with 15 U.S.C. § 1232 for that vehicle.” For this language, statute item Item (1) appears to be the nearest match, then, as “retail price of such automobile suggested by the manufacturer.”

Noting that item (2) is a requirement to list not the “retail price” of the automobile, but instead the retail “delivered” price, “for each accessory or item of optional equipment, physically attached to such automobile,” I deduce (from my armchair) that item (2) is not included within the IRS’s notion of “manufacturer’s suggested retail price for the vehicle” but instead the “MSRP” for the optional equipment. (And more certainly it’s not the case that item (3), delivery charges, are a “retail price” at all, much less inherent to the price of the vehicle.)

Instead (from my armchair), the IRS’s notion of “MSRP” for the vehicle I take to relate only to item (1) in the statute. (If anyone has on-point rulings from the IRS relarinf to the QAFMV credit definition of MSRP, that might settle it!)

On this view,” “MSRP” appears to mean the price of the base trim level before options or delivery.

(3) The view that “MSRP” mean the price of the base trim level before options and delivery is probably supported by examples of Monroney Stickers

Taking this view of “MSRP,” it has the benefit of seeming to square with the Monroney Sticker themselves:

Note that there is listed an “MSRP” for the vehicle, separately from the “MSRP” for the options, and together - along with D&D - described as “total” MSRP.

Looking at the sticker alone, one might worry if the new EV law’s reference to “MSRP” could be to the “total” number on the sticker; but looking first to the IRS’s prior guidance and the operative code language regarding the MSRP for “the vehicle,” as distinct from MSRP for options/D&D, the sticker instead seems to support the read that the IRS is looking to - in effect - the base trim level MSRP, before options.

(4) What does this mean for MY23 F150L?

From over here at Motor1.com I pulled this helpful little chart, which I assume to be accurate regarding what little is currently known for Ford’s released MY23 pricing:

However, since we (I?) believe D&D is excluded from the IRS-relevant notion of MSRP, I’ve further backed the above numbers down to exclude D&D and then stoplight color-coded for what does or doesn't hit the notional IRA cap for pickup MSRPs:

| Model | 2023 Model Year (EXCLUDING $1,795 Destination) |

| Pro | $47,001 |

| XLT | $59,474 |

| XLT High | $68,474 |

| XLT High Extended Range | $80,974 |

| Lariat | $74,474 |

| Lariat Extended Range | $85,954 |

| Platinum Extended Range | $96,724 |

I’ve placed the XLT ER in yellow, because when I saw the price within spitting distance of the MSRP cap I wondered something fanciful: if chip shortages continue to result in “required deletions” from a trim level, are any applicable to the XLT ER, and if so could the resulting price reduction >$975?

For example, the on board scales are a part of the XLT ER, and are I believe a known “required” deletion for 2023 orders (so far). To what price reduction?

And, I believe that these deleted “standard” items result in Ford issuing a window sticker with a reduced “base” MSRP.

(5) In fact, could a dealer build an XLT ER with a sub-$80K sticker MSRP?

Setting aside chip shortage deletions, and maybe more to the point: could a customer ask their dealer to order an XLT ER that proactively deletes certain “standard” equipment, and receive a price reduction for those equipment deletions?

If so, is there non-critical XLT ER equipment that could result in a >$975 price reduction? (Even better if it is equipment that could later be dealer-installed?)

If a person could up-front confirm with their dealer that the window-sticker would show a sub-$80K base MSRP, it might be possible to build an ER Lightning that comes in under the $80K IRA MSRP cap.

Of course, awaiting the IRA guidance from the IRS should prove out whether the above-described MSRP calculation is correct. And, anyone over the income cap is busted, anyway. Not to mention separately still needing a final understanding of the battery minerals and assembly requirements and where Ford comes out there.

Oh well. Perhaps the next inflection point in this fanciful thought will be seeing a window sticker for someone with an order that deleted the onboard scales, to see how that credit is reflected on the window sticker

Sponsored