Maxx

Well-known member

I share most of what I think may be useful to Ford but keep driving data off almost all the time. Except when it is really cold out there and I know I will be traveling long distance the next day. Charging over night to 80% and use the Ford Pass in the morning to Top it off and get the battery toasty right before I leave. Then turn it off when I get in the truck. I am hoping that means no driving data is shared since there was no driving done while it was on. However hope does not mean a thing if the truck has an accumulated collected data and share it as soon as I turn it on.Thanks for reaching out and asking the question; never hurts to ask!

I'm personally leaving it on, as I want that functionality, and the data collection doesn't bother me as much as it might others. It's a very personal choice. YMMV.

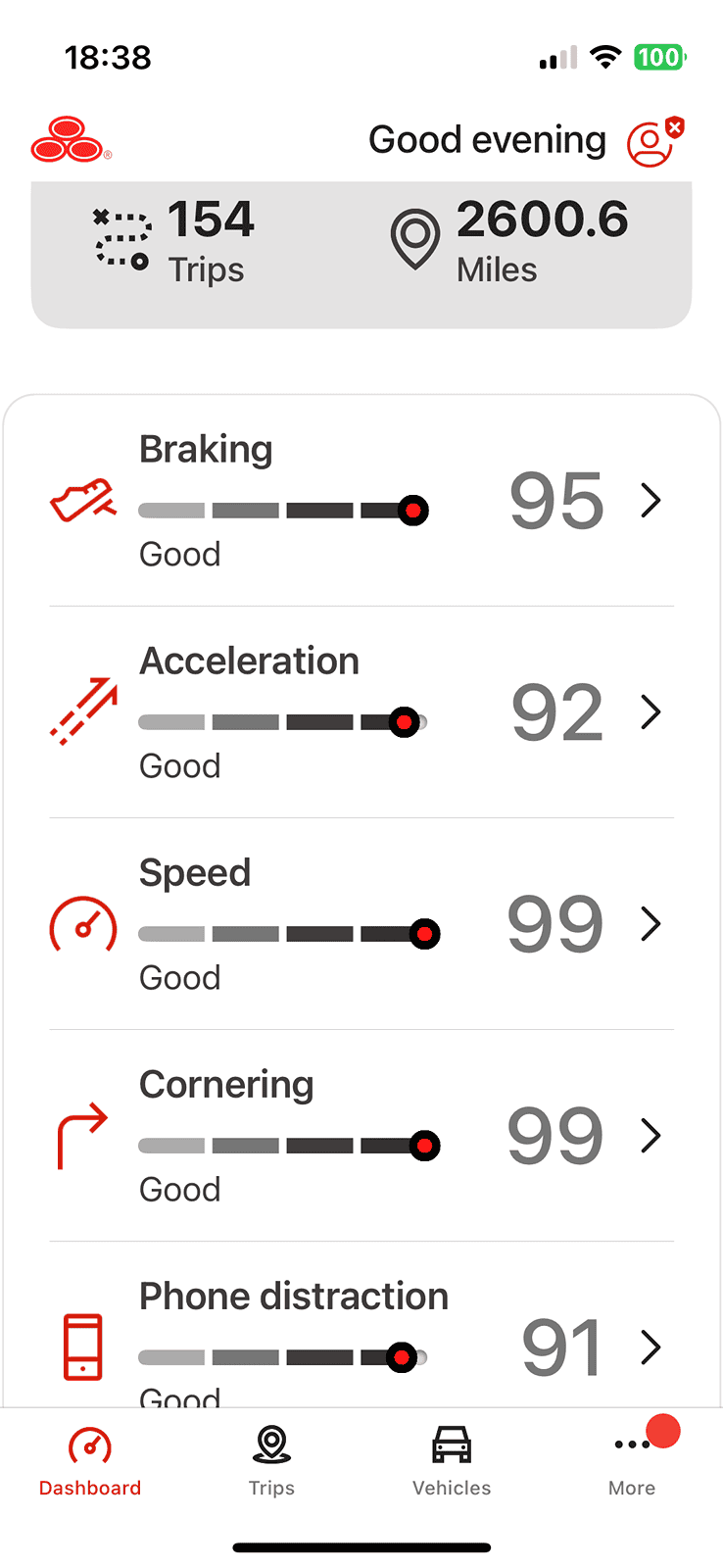

My Share Insurance data is disabled even when I turn on the share driving data. Does anyone know what it is tied to?

Sponsored

Last edited: