chl

Well-known member

- First Name

- CHRIS

- Joined

- Dec 16, 2022

- Threads

- 7

- Messages

- 2,229

- Reaction score

- 1,371

- Location

- alexandria virginia

- Vehicles

- 2023 F-150 LIGHTNING, 2012 Nissan Leaf, 2015 Toyota Prius, 2000 HD 883 Sportster

- Occupation

- Patent Atty / Electrical Engineer

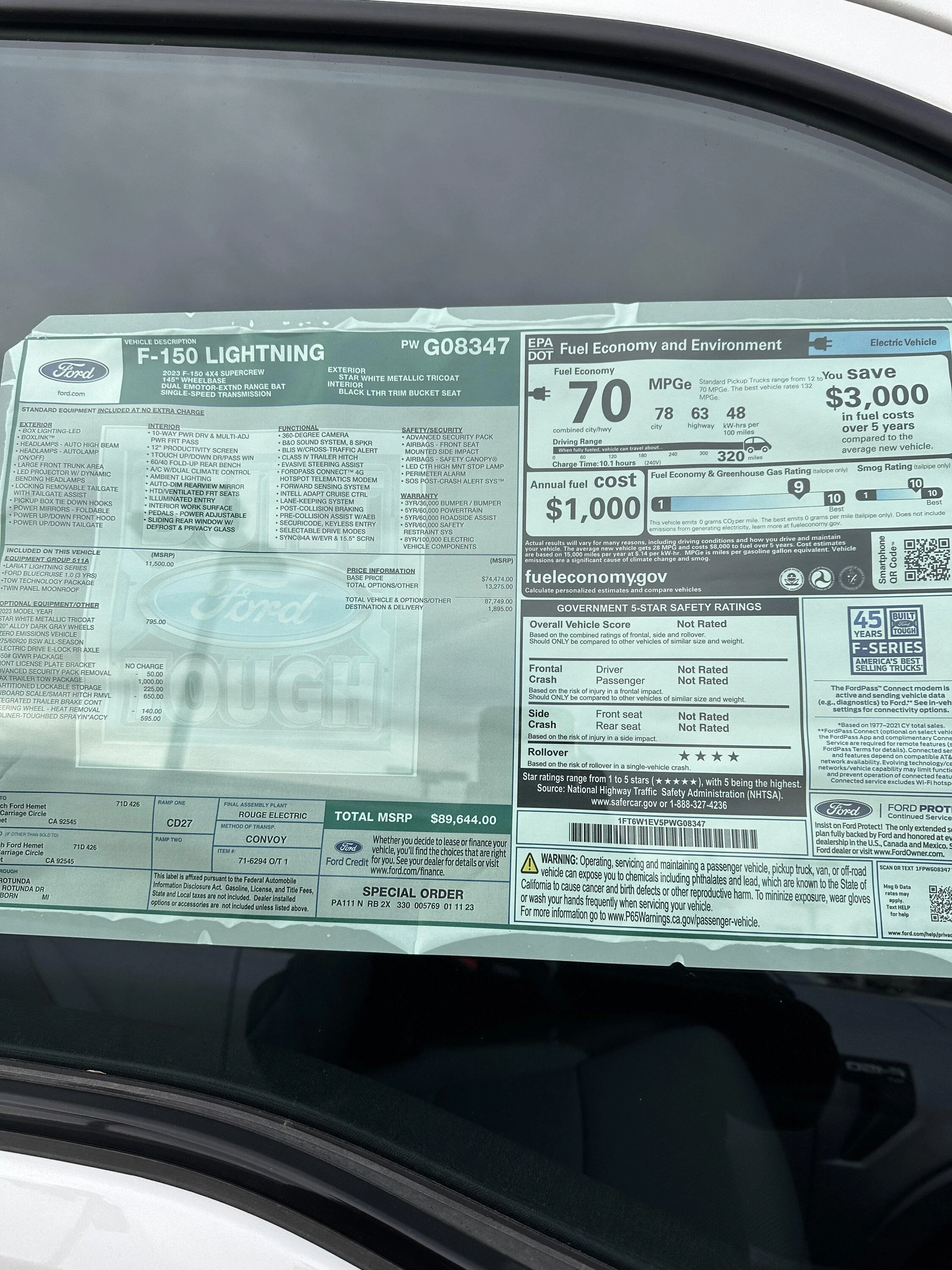

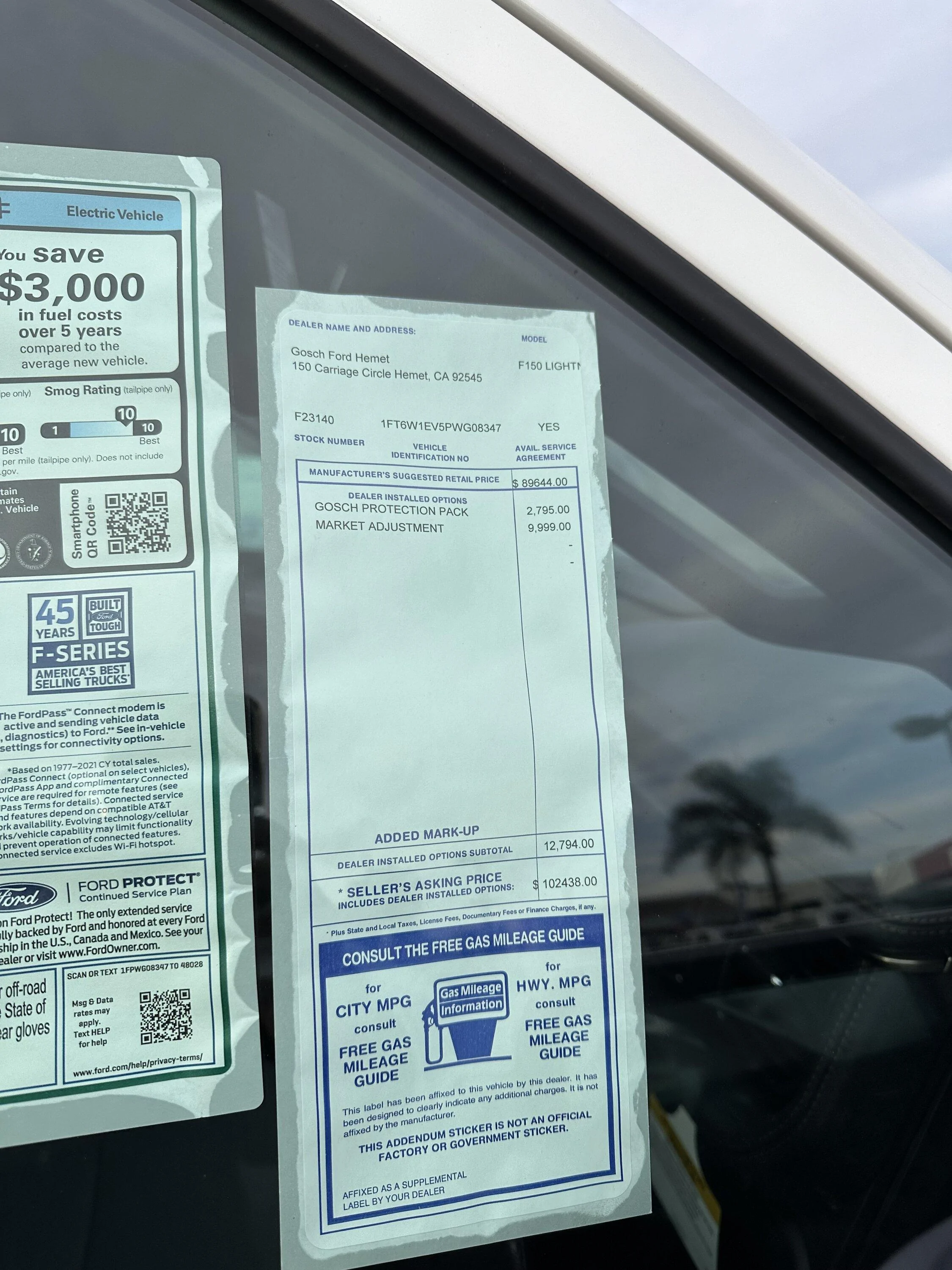

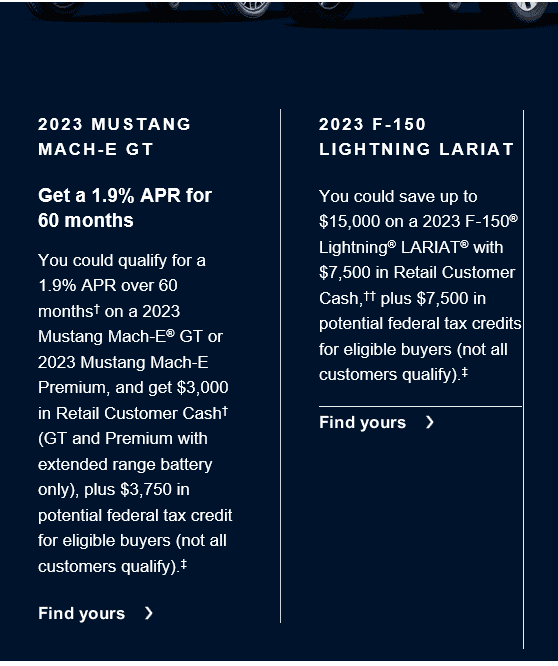

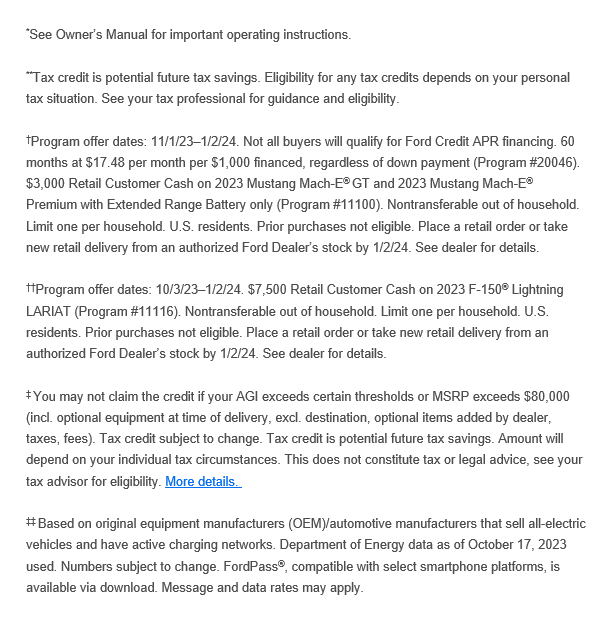

Their Market Adjustments aren’t working for these Trucks anymore. Ford will either throw more incentive money or just stop sending that dealer trucks. I mean some of these dealers are smoking some good stuff

OMG the greed!Their Market Adjustments aren’t working for these Trucks anymore. Ford will either throw more incentive money or just stop sending that dealer trucks. I mean some of these dealers are smoking some good stuff

Maybe they want you to pay up-front for all the service you won't need from them for tune-ups, oil changes, transmission service, etc. over the next 10 years or so?

Fight inflation: walk away from that place as fast as you can.

Sponsored