chl

Well-known member

- First Name

- CHRIS

- Joined

- Dec 16, 2022

- Threads

- 7

- Messages

- 2,428

- Reaction score

- 1,501

- Location

- alexandria virginia

- Vehicles

- 2023 F-150 LIGHTNING, 2012 Nissan Leaf, 2015 Toyota Prius, 2000 HD 883 Sportster

- Occupation

- Patent Atty / Electrical Engineer

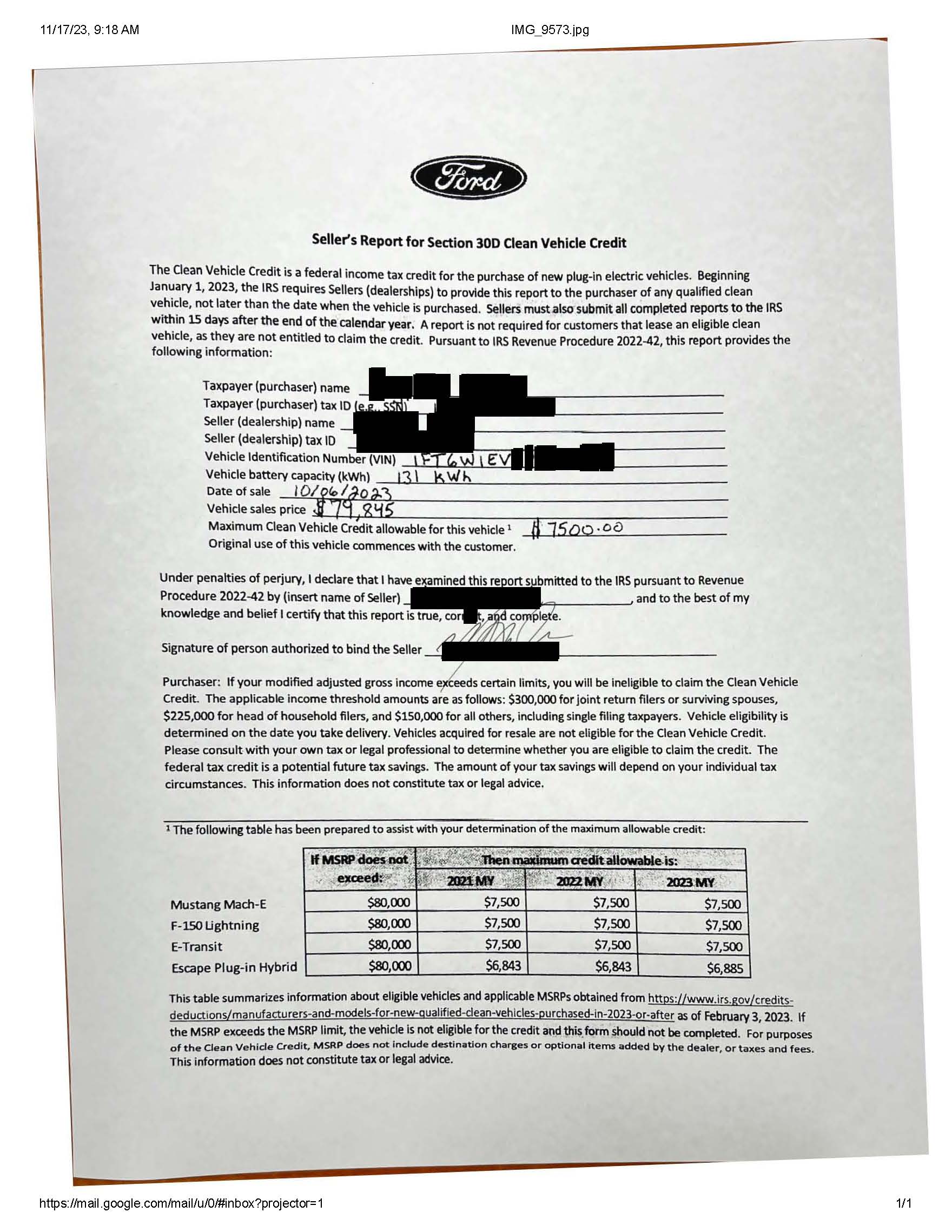

I think they mentioned I was the first purchase of an EV in 2024 (Jan 4 2024). They never gave me any additional paper work/confirmation about the credit "before I left the dealership" as the meme suggests I maybe should have gotten, or at least I don't remember getting it.

My dealer said they were not sure how it all worked yet.

I just checked my paperwork.

They credited me with $9500 as part of an "additional down payment on delivery" on the sales paperwork, I gave them $2000 on my CC.

No where does it say they claimed the tax credit, and no confirmation about the credit.

So I guess they never figured it out and never claimed the tax credit.

They had a lot of 2023 Lightnings to move so I guess I got a better deal than I thought I was getting!

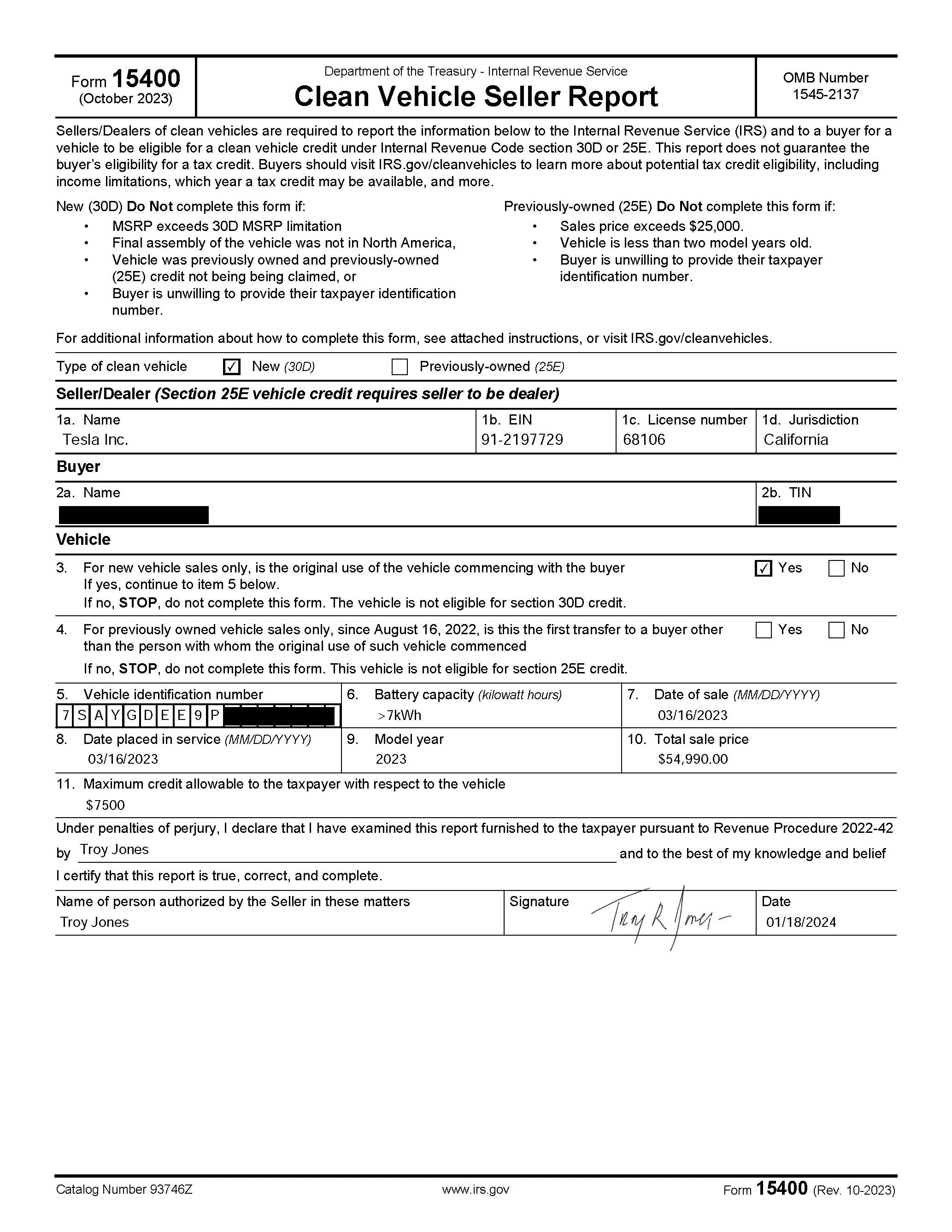

And now it seems I can claim it when I file my 2024 tax year return.

Yahoo - but I better double check before I claim it.

A little wrinkle on the income cap I was unaware of until I looked it up just now - "income for the year before:"

"To qualify for the tax credit, your modified adjusted gross income cannot exceed a certain threshold: $150,000 for single filers, $225,000 for heads of households and $300,000 for married couples. You can qualify based on your income for the year you take delivery of the vehicle or the year before."

My dealer said they were not sure how it all worked yet.

I just checked my paperwork.

They credited me with $9500 as part of an "additional down payment on delivery" on the sales paperwork, I gave them $2000 on my CC.

No where does it say they claimed the tax credit, and no confirmation about the credit.

So I guess they never figured it out and never claimed the tax credit.

They had a lot of 2023 Lightnings to move so I guess I got a better deal than I thought I was getting!

And now it seems I can claim it when I file my 2024 tax year return.

Yahoo - but I better double check before I claim it.

A little wrinkle on the income cap I was unaware of until I looked it up just now - "income for the year before:"

"To qualify for the tax credit, your modified adjusted gross income cannot exceed a certain threshold: $150,000 for single filers, $225,000 for heads of households and $300,000 for married couples. You can qualify based on your income for the year you take delivery of the vehicle or the year before."

Sponsored